With the European Union set to impose punishing tariffs on Chinese solar panels on June 5, you’d think companies like Yingli, the world’s largest photovoltaic manufacturer, would be concerned. After all, Germany and other European countries have long been the biggest market for Chinese solar panels.

However, on a conference call yesterday to announce first quarter earnings, Yingli executives sounded sanguine about the impact of tariffs on their bottom line. That’s partly because ongoing negotiations between Chinese officials and their European counterparts to avoid the tariffs make it unclear just what will happen next week. As the New York Times reported on May 30, Germany, China’s biggest European trade partner, opposes levying tariffs in retaliation for the dumping of Chinese solar panels on the European market below their cost.

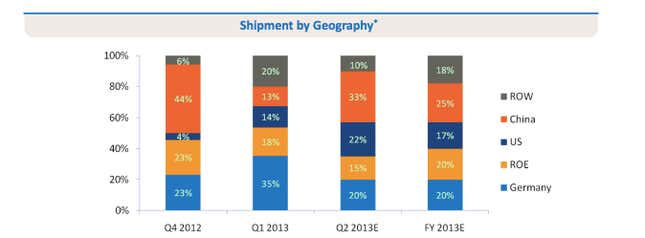

But a look at Yingli’s global shipments of solar panels also shows why Europe isn’t playing the outsize role it once did. China, Japan, the US, and emerging markets like South Africa now soak up a growing share of the company’s manufacturing capacity.

In the first quarter, Europe accounted for 53% of Yingli’s shipments. But the company projects that by year’s end, Europe’s share will fall to 40%, with China accounting for 25% of shipments, and 17% going to the US.

In the fourth quarter of 2012, emerging markets, or what Yingli calls rest of the world (ROW), took 4% of the company’s panels; in the first quarter of this year, that number jumped to 20% and is expected to account for 18% of shipments for the year. For instance, yesterday Yingli announced that a 96-megawatt (MW) South African photovoltaic power plant partly financed by Google would use the company’s solar panels.

“Especially in China, US, and Japan, we see strong demand,” said Yingli chief financial officer Yiyu Wang.

The Chinese government has decreed that 10,000 megawatts of solar capacity be installed in 2013, and Yingli said that earlier this month that it won a contract to supply 220 MW of solar panels for a domestic project.

And though the US last year imposed tariffs on Chinese-made solar cells, it doesn’t seem to have slowed Yingli’s expansion in that market. Robert Petrina, managing director of Yingli Americas, said the company had its second highest shipments to the US in the first quarter.

Yingli and other Chinese manufacturers have avoided those tariffs by buying solar cells from non-Chinese suppliers or building factories outside of China. Yingli executives said they are considering a similar strategy if Europe imposes tariffs next week.

“One thing is for sure, the cost increase will be significantly below the tariff levels, which is why an overseas facility solution will be an effective solution to avoid the anti-dumping case,” Wang said.