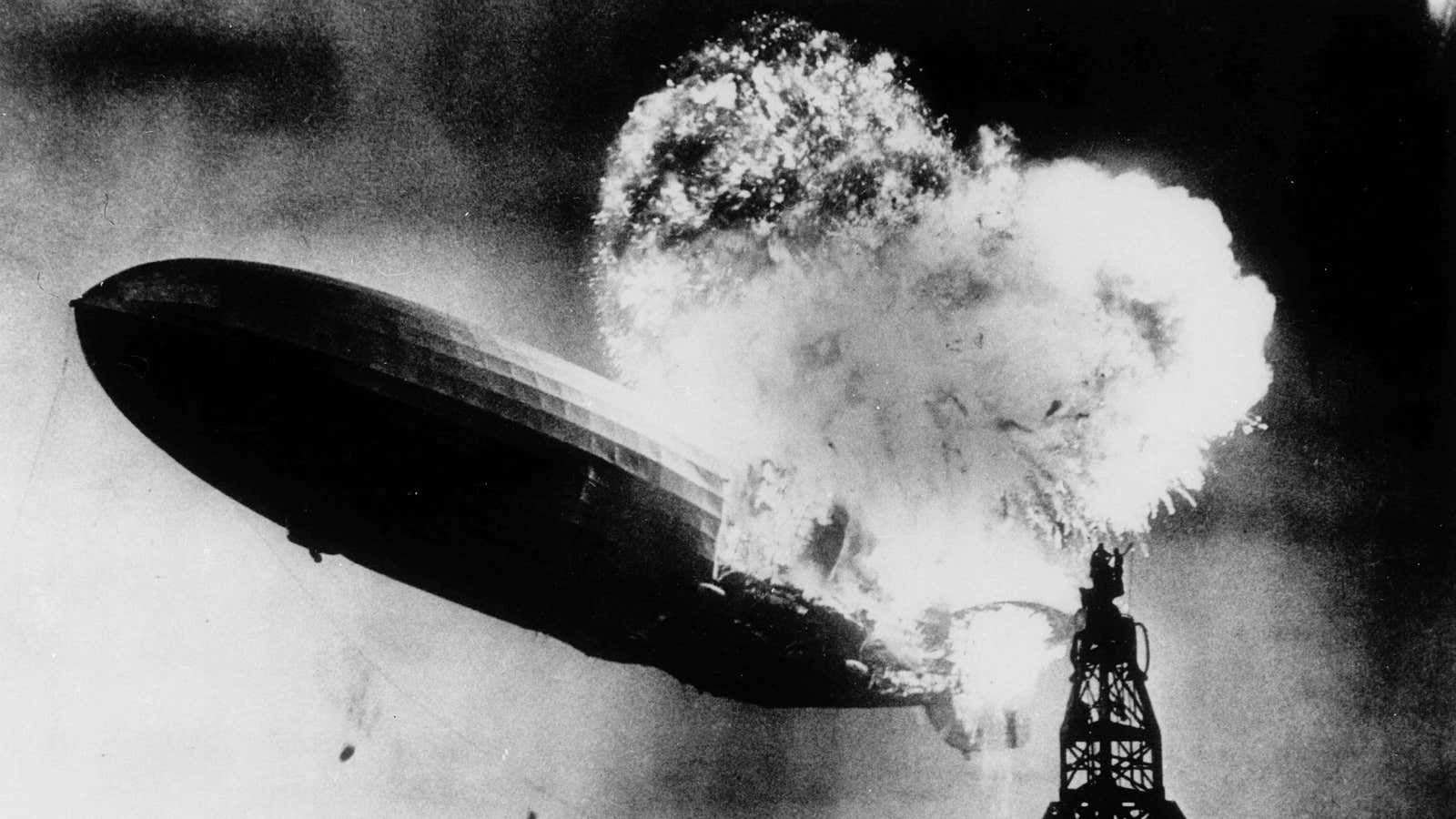

The nonsensical “Hindenburg omen” is supposed to have cast its zeppelin-shaped shadow across US markets again.

And true enough, US stocks did have an ugly session, especially going into the close. (Though they had a rock solid May, rising more than 2%.) That late-day decline may have been caused by an analyst’s omen sighting.

For those that need a quick refresher, here’s how the Wall Street Journal described this ridiculous tool of “technical analysis,” which was created by blind, skeet-shooting mathematician Jim Miekka, when it last sent the market into a tizzy in August 2010:

Mr. Miekka came up with the Omen in 1995 as a way to predict big market downturns, developing a formula that parses data like 52-week stock levels and the moving averages of the New York Stock Exchange. He said the Hindenburg Omen’s name was coined by a fellow market technician, Kennedy Gammage, when they found out the name “Titanic” already had been taken.

Has it worked? No! Of course not.

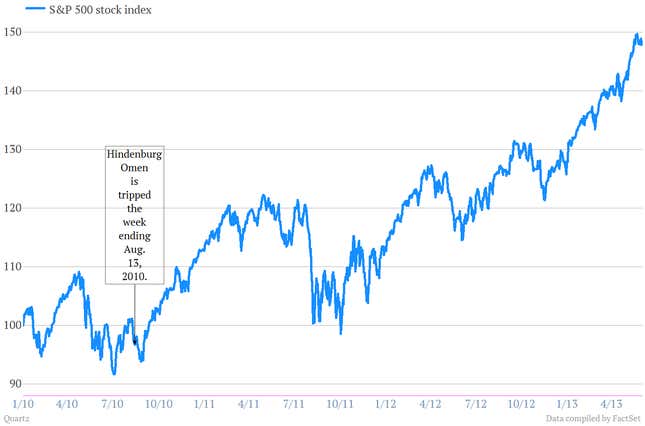

As the Journal pointed out, the “omen” was tripped the week that ended Aug. 13, 2010. And stocks collapsed right? No, they slipped slightly for a few days and then continued rallying all the way through the spring of 2011. Judge for yourself whether dumping all your stocks was the right decision last time this omen arrived:

Terrifying, right?

But does that mean you should ignore today’s selloff? Well, on that point, recall that the last time everybody was getting twitchy about the Hindenburg was also a period of considerable uncertainty related to US Federal Reserve policy. (If you haven’t noticed, that’s what we have now, too.)

The Fed’s initial bond buying programs, which it entered into during the worst of the recession to try to fend off a second great depression, were on pause in August 2010. Yet the economy seemed quite weak. It wasn’t until Fed chairman Ben Bernanke opened the door to more action, in a now-famous speech at the Fed’s Jackson Home, Wyo., conference, that the stock market decided it wanted to move higher.

With the Fed now making serious sounds about trimming back its bond-buying programs, we’re likely going to see a lot more volatility in the markets. Investors are unsure if the US economy can keep rolling without a steady push from the central bank.

So we’re not saying that stocks can’t fall. We’re just saying if they do fall, it won’t be because of a spookily named bit of technical flim-flam.