Encouraging urbanization to boost domestic spending is one of Beijing’s top policy priorities, but the government’s efforts to do so are already hitting roadblocks.

Chinese officials are calling for a kind of populist urbanization. The Chinese word for it translates more directly as “small city-ization,” rather than “urbanization.” The phrase is meant to signify a focus on developing emerging cities, rather than expanding large existing cities. (By 2025, China is expected to have over 200 cities with populations of more than 1 million.) Why? According to premier Li Keqiang, city dwellers spend more than rural residents on services like schools, healthcare, leisure and financial advice—all things that would boost the country’s services sector and decrease its export dependence.

This services industry is important, Li says, because it’s “capable of absorbing the largest number of new employees and is an important driving force behind scientific and technological innovation.”

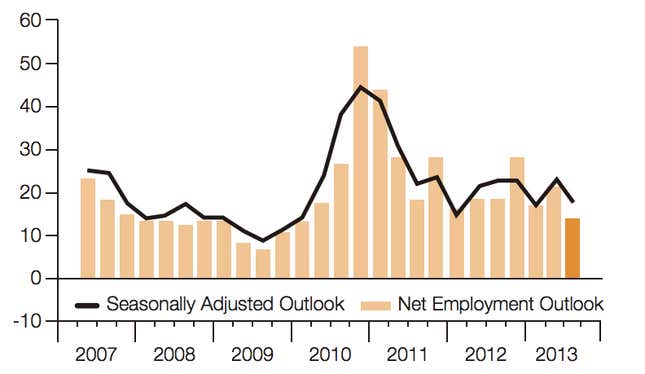

So far, the sector is lagging. Last month, HSBC’s purchasing managers index for the services industry registered its second-lowest reading since August 2011. According to a recent ManpowerGroup survey (pdf) of 4,241 employers in China, service sector employers reported their lowest hiring expectations since 2010.

The question is how a small city urbanization strategy will translate into spending. Incomes of Chinese families living in cities are growing: Urban household income should double by 2022, (pdf) if the government’s urbanization measures go as planned, according to McKinsey & Company. At that point, over 75% of urban Chinese will be earning between 60,000 and 229,000 yuan ($9,000 to $34,000) a year. (Income refers to annual household disposable income based on real 2010 terms.)

However, new entrants to cities, usually migrant workers from rural areas, tend to maintain their old shopping habits and send most of their money home. Their new urban domicile is just a place to sleep and eat, according to Dale Preston of Nielsen Greater China, which researches consumer behavior in the country.

The government’s urbanization policies may not work. Last month, policymakers reportedly halted a plan to spend $6.5 trillion (yes, that’s trillion) of investment for roads, homes, social welfare benefits and other public services. Possible reasons are that China’s local government debt is already too high, and its property market is too volatile. A lack of investment in newly developing cities could exacerbate poverty, pollution, congestion and crime. In that case, new cities wouldn’t be a boon for the economy; they’d be a big drag, just like the old ones.