If Brazil is going to maintain its grasp on the global orange juice market, it’s going to have to shake things up a bit.

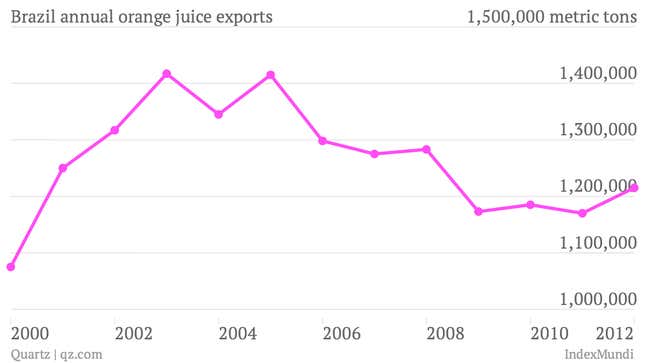

Brazil makes and distributes more orange juice than any other country in the world, and it’s not even a close race—the country makes more than 50% of the world’s orange juice. But recent history hasn’t been all that kind to the citrus giant. Orange juice production has grown stagnant over the past few years and orange juice exports, which the local industry relies heavily on, have fallen almost 15% since their peak in 2003.

What’s going on? A few things.

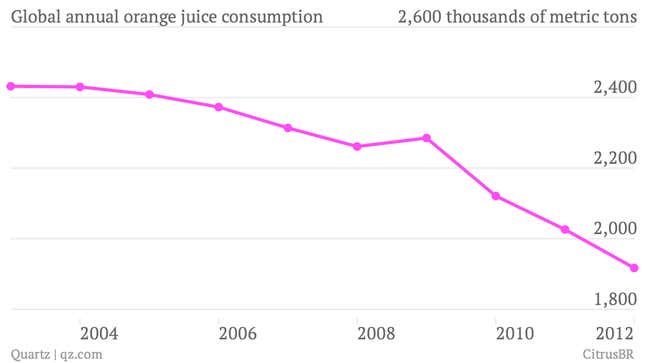

People are drinking less orange juice these days

There are nearly one billion more people in the world than there were in 2000, and yet the world, as a whole, drinks less orange juice today than it did then. Led by big drops in the US and Europe, the world’s two largest markets for orange juice, orange juice consumption has shrunk in virtually every year this decade. If you export over 98% of the orange juice you produce, as Brazil does, that’s a serious problem.

Especially if profit margins are shrinking, too.

Exporting orange juice is getting expensive

Even if there were enough demand to sweep more oranges out of farmer’s hands, growing oranges isn’t all that lucrative in Brazil anymore. An updated labor code has driven up the minimum wage, and land lease costs and prices of pesticides have risen, too. At this point, it may not even be cost-effective for smaller growers to produce oranges in Brazil anymore, Marco Antonio dos Santos, the president of a local grower’s union, told Agence France-Presse:

The government calculated that we have a production cost of around 5 dollars per crate (40.8 kilograms or 90 pounds), while we are selling it at 3.5 to 4 dollars…In the citrus belt of Sao Paulo, half of the orange farms have disappeared over the past 10 years, and only the most productive survive.

And exporting them? That’s even more costly. The price of processing and transporting the orange juice to overseas terminals has risen steeply—over 50% since 2000—in part due to rising oil prices.

Orange juice. Orange juice. Who wants orange juice?

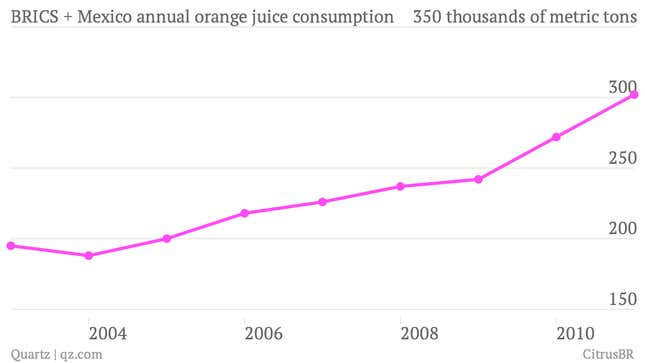

As orange juice exports go, so too does Brazil’s entire orange juice industry. The good news is, though fewer people are drinking orange juice overall these days, the decline is largely driven by shrinking demand in the US and Europe, where consumption has fallen roughly 20% and 5% since 2003, respectively.

In many emerging markets, by contrast, demand for orange juice is growing. The numbers are modest, mind you, but with promising growth and billions of prospective consumers, the potential is certainly there. Growing the market outside of the US and Europe, which together account for roughly 80% of Brazil’s orange juice exports, in countries like China and Russia could help protect the country’s smarting citrus industry from the decline happening in developed countries, and pivot for the future.

But if Brazil wants to inject life into its ailing orange juice industry, it may want to begin by getting its own people to start drinking orange juice.

Currently the world’s 10th largest consumer of packaged orange juice, Brazil has seen its own consumption rise only 8% since 2003. Compare that to China, which consumes more than twice as much juice as it did in 2003, or Russia, which consumes 70% more. Since per-capita incomes have risen a good deal in all three countries, this suggests that getting Brazilians to drink more of the stuff isn’t just a matter of waiting for them to get more prosperous. (Note, though: The data don’t capture orange juice freshly squeezed on the spot, which is, naturally, much more common in Brazil than in China or Russia.)

Some nonetheless see promise in the Brazilian market. “In a few years, our country can have as many people drinking industrial orange juice as in Germany, which is the world’s leading consumer per capita,” dos Santos told the AFP. Brazil certainly hopes he’s right.