US Federal Reserve chairman Ben Bernanke shook markets yesterday with a speech that laid down a timeline for the Fed to wind down its quantitative easing (QE) program. But his pronouncements are having a very strange effect.

The Fed’s purchases—currently running at $85 billion a month—of US bonds were meant to drive down their yields and push investors into other, riskier kinds of assets, such as stocks, where yields are higher. So as the Fed starts winding down the program, Treasury yields should rise. We’re already seeing signs of that even though the Fed hasn’t started pulling back yet. US Treasurys yielded 2.2% on June 18, the day before the Fed’s announcement, and now yield 2.4%, a sign that investors are selling them.

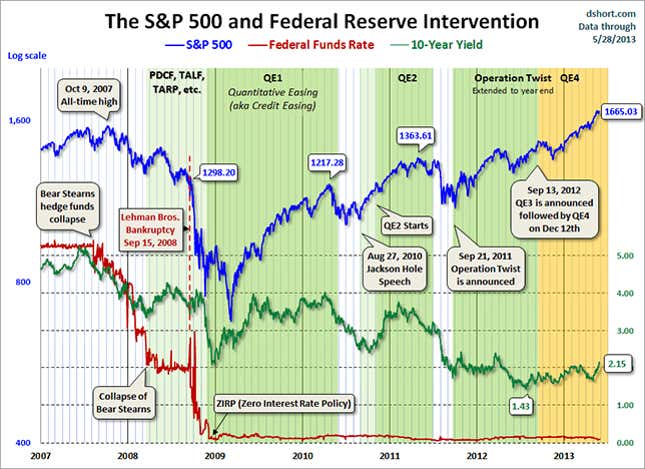

But the effects of QE have gone far beyond Treasurys. Each successive QE program—this one, depending on how you count them, is the third or fourth—has directly correlated with rising prices of stocks and money flowing into emerging markets. Now that investors expect the QE program to wind down, markets are falling across the world.

Typically, though, when investors are selling off Treasurys you’d see them moving their money into safer assets, including outside the US. Gold, German bunds and Japanese government bonds have been stalwarts in moments of panic. But that’s just not happening; markets appear to be selling off in tandem.

The effect is most apparent in 10-year Bunds (German government bonds). Even though they’ve been considered the quintessential European safe haven over the last few years—the one place in Europe that could withstand the sovereign debt crisis—they might as well be US Treasurys right now. Rather than falling as one might expect in response to the Fed’s news, yields on 10-year Bunds rose from 1.56% yesterday to 1.65% today, even though the European Central Bank has shown no desire to scale back its easy monetary policy recently. Yields on Swiss government bonds are also up, from 0.77% yesterday to 0.84% today. Yields on Japanese government bonds have continued to rise. The value of the Swiss franc (so strong a safe haven that its central bank had to impose a floor to keep investors out) has fallen 3% today.

The message for investors today? There’s nowhere to hide, and no-one is sure exactly what’s next.