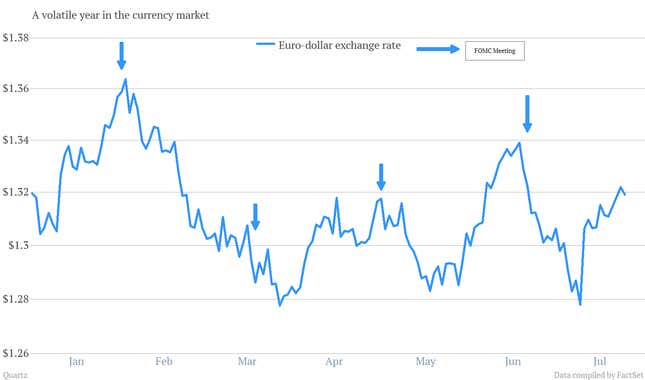

The Federal Reserve has spooked markets with its gnomic pronouncements, but human traders should take heart: Currency funds that rely on computer trading have fared much worse in 2013, as markets respond more to psychology and political intrigue. In the first half of the year, computer-managed funds earned a return of 0.7% and human-managed funds a return of 2.3%, according to data from Parker Global Strategies as reported by Bloomberg.

Probability models are finding it exceedingly difficult to predict how markets will react to central bank attempts to stimulate the economy in a world of low interest rates. Carbon- and silicon-based market participants alike have been following US Federal Reserve’s open market committee meetings and speeches by Chairman Ben Bernanke, trying to understand the Fed’s schedule for slowing its bond purchase program. Their interpretations and mis-interpretations of those messages cause big swings in the euro-dollar exchange rate, leaving funds in the carry trade across currencies in trouble if they can’t shift positions fast enough.

While the quant funds have traditionally outperformed their human competitors by relying on indicators and formulae, this year they’ve been baffled by the swings, and haven’t moved fast enough to avoid losses when the carry trade reverses. That’s symptomatic of the broader problem with failing risk indicators as markets remain focused on central bank’s efforts to guide their various economies out of the global recession. In the meantime, humans can celebrate a brief advantage over the machines.

And if you think that’s fun, wait until President Obama nominates Bernanke’s replacement sometime in the next few months. Sources say the next Federal Reserve chair almost certainly won’t be a robot.