Bernanke’s incredibly simple message still befuddles markets

With the US economy looking kinda-sorta okay—or at least more okay than it’s looked since the financial crisis hit—the chatter has once again turned to the Federal Reserve’s “exit strategy.” In other words, people want to know when the central bank is going to start to take the training wheels off the US economy, by cutting down on its policies of creating new money and using it to buy bonds (“quantitative easing,” or QE).

With the US economy looking kinda-sorta okay—or at least more okay than it’s looked since the financial crisis hit—the chatter has once again turned to the Federal Reserve’s “exit strategy.” In other words, people want to know when the central bank is going to start to take the training wheels off the US economy, by cutting down on its policies of creating new money and using it to buy bonds (“quantitative easing,” or QE).

Now, bear in mind, the Fed has already spelled some of this out. As long as there are no red flags on inflation, the Fed says it’s going to stick with QE at least until unemployment falls to 6.5%. We’re currently at 7.5%. And by the way, if anything, inflation is lower than the Federal Reserve’s target of roughly 2%. So there’s very little to suggest that the Fed is near the point of reducing its support to the economy. Even so, some in the markets were at least a little concerned that Fed chairman Ben Bernanke’s Congressional utterances today might signal a course change ahead.

They didn’t. From the get-go Bernanke’s tone reassured the markets that the Fed wasn’t going anywhere. Here’s the key quote from his opening remarks: “A premature tightening of monetary policy could lead interest rates to rise temporarily but would also carry a substantial risk of slowing or ending the economic recovery and causing inflation to fall further.”

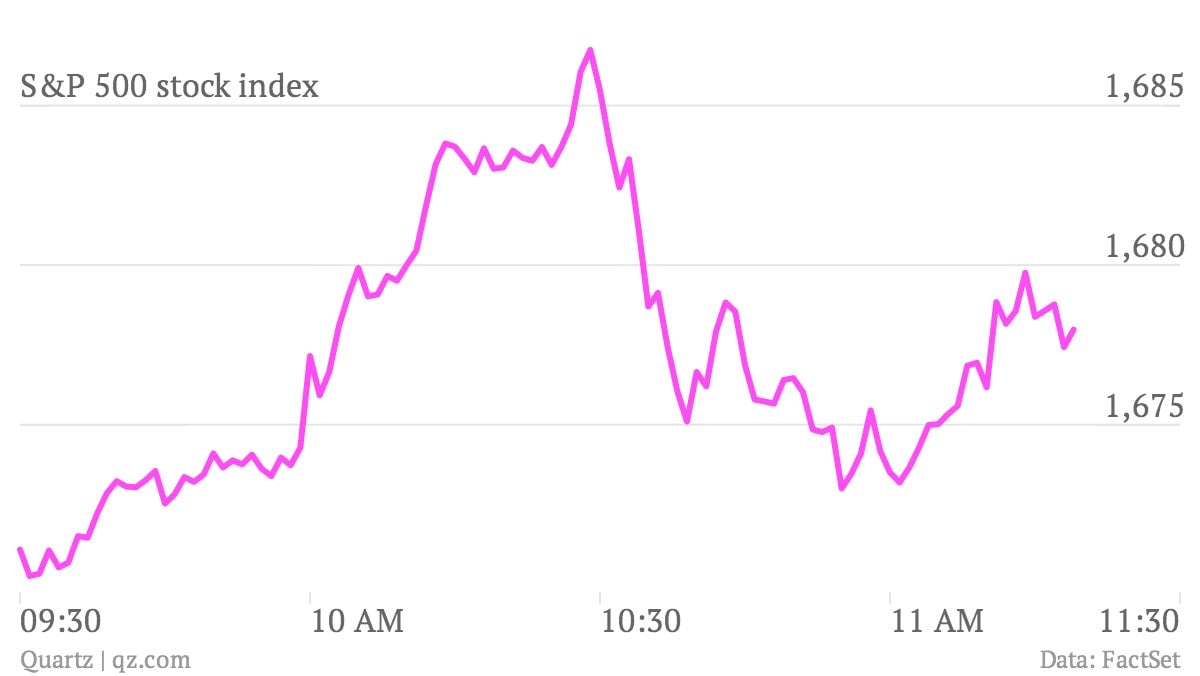

Bernanke’s tone seemed to please investors in riskier types of markets like stocks. Here’s a look at the S&P 500 futures this morning. They took off once Bernanke’s testimony hit at around 10 a.m. EST, which suggested that stock investors thought they heard Bernanke say QE was going to keep going strong, though the gains started to dissipate a bit as the testimony continued. (It’s also worth noting that around the same the Fed testimony went public, existing home sales data also arrived especially strong. Sales of existing homes hit their highest level in about three-and-a-half years.)

The reaction of the bond market was also a little confused. Initially, yields on the benchmark 10-year note, for example, declined. That makes sense, as the Fed was saying it will keep buying bonds. Buying bonds adds to the demand for them and pushes yields down. But then yields turned around and moved sharply higher.

That could mean that some investors still see a risk that the Fed could back off, and want to sell bonds before it happens. On the other hand, a rise in yields could also mean investors believe QE will continue but is helping to generate growth or risks spurring inflation (which is the great bogeyman for bond investors, because it eats into the purchasing power of fixed income investments over time.)