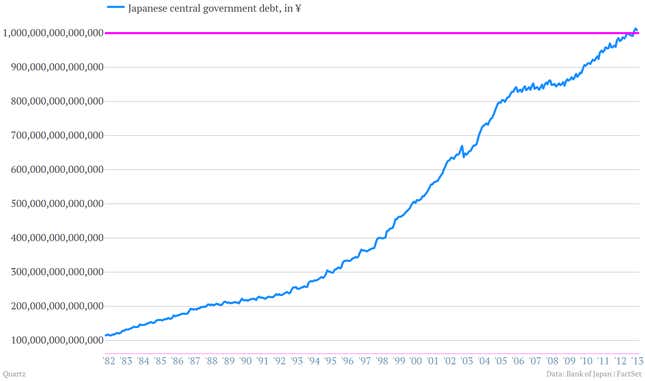

Japan’s debt load has passed the numerically numbing level of ¥1 quadrillion. That’s fifteen zeroes: ¥1,000,000,000,000,000. Or, to be exact, ¥1,008,628,000,000,000, as of the end of June. (In US dollar terms, it’s a bit less than $10.5 trillion.)

Eye-catching, to be sure. But it isn’t especially meaningful. It’s more like a game of decimal points. Right now, the yen is about the equivalent to the US cent. You could also make the US debt look a lot more outlandish by expressing it as ¢1,674,000,000,000,000 rather than $16.74 trillion.

So, yes, while Japan does have a ton of debt, the outright level is not the best way to keep track of it. The more important gauge is debt as a percentage of the country’s annual economic output, or GDP. And at more than 200%, Japan’s debt load is the highest among all developed nations.

So shouldn’t Japan immediately set about raising taxes and cutting spending to try to get that debt under control? No, it shouldn’t.

The goal of economic policy makers should be to reduce the debt—as a share of GDP. That’s because debt-to-GDP gives you a quick snapshot of how easy or difficult it is for a nation to carry its debt load and pay its bills, which is what markets care about most.

And history has shown us that the best way to reduce a nation’s debt-to-GDP ratio is is to focus on boosting GDP rather than cutting debt. By concentrating on enlarging the denominator, you get a smaller number for debt-to-GDP. You also often get a favorable decline in the numerator, as well, thanks to improved tax receipts and declining spending on things like unemployment benefits.

Don’t believe us? Just listen to the folks who are paid to monitor Japan’s debt load. Moody’s analysts recently published a note on Japan’s sovereign debt entitled “Higher Growth Essential To Reduce Japan’s Large Government Debt Burden.” In it, they write:

Ending deflation and achieving stronger nominal GDP growth would also help reduce the government’s large gross financing requirements and relieve the burden on fiscal austerity, helping in turn to free up savings for more productive private sector investment. A revived economy and smaller fiscal deficit would stabilize and eventually reverse the current upward trajectory in debt through simultaneous improvements in the numerator and denominator of the country’s debt-to-GDP ratio.

But still, how will Japan ever manage to pay it off it’s debt? Well, actually, it won’t.

That’s not how developed economies work. Even the most fiscally upright nations, such as Germany, have trillions in debt. At the end of 2012, Deutschland has about $2.9 trillion in central government debt, or more than 80% of GDP. The goal for countries isn’t paying off debt, it’s getting its debt-to-GDP ratio in better shape.

For Japan, the only way out is through growth. And that’s why the aggressive strategy to jumpstart growth spearheaded by Prime Minister Shinzo Abe is so crucial to the country’s future. But that means Japan will have to do much better than the softer-than-expected 2.6% annual growth rate it produced in the second quarter.