The US government’s decision to block a merger between US Airways and American Airlines came as a bit of surprise, but maybe it shouldn’t have, given the loose lips of some of the executives involved.

US Airways, whose executives will lead the combined company, is fighting the US Department of Justice. It argues the combined company will give flyers more options. But the government told a federal court (pdf) it fears that the remaining four big airlines will start acting like a cartel—raising prices and limiting service—if there’s no real competition. Now, why would it think that?

Because the executives keep saying so

US Airways president Scott Kirby told a trade conference “three successful fare increases – [we are] able to pass along to customers because of consolidation” and that “consolidation has also . . . allowed the industry to do things like ancillary revenues [e.g., checked bag and ticket change fees] . . . . That is a structural permanent change to the industry and one that’s impossible to overstate the benefit from it.” His boss, CEO Doug Parker, maintains that consolidation will “rationalize” the industry.

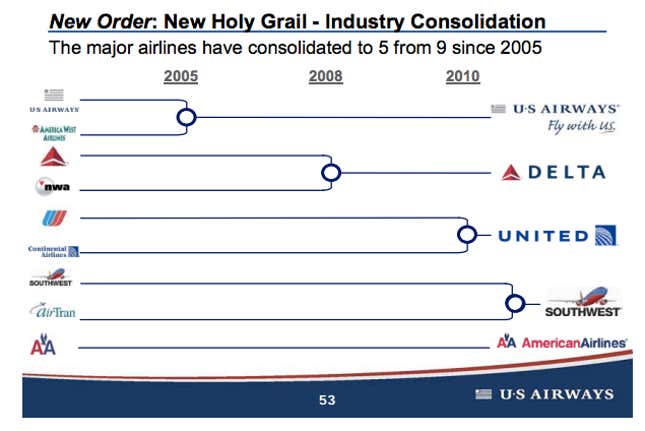

Because US Airways called consolidation the “new Holy Grail”

Because US Airways’ CEO urged Delta’s CEO to raise prices

In 2010, when Delta rolled out a new discount promotion, Parker complained in an e-mail chain with his executives that the move was “hurting [Delta’s] profitability – and unfortunately everyone else’s” and also urged them to bad-mouth Delta to Wall Street. Parker forwarded the whole e-mail chain to Delta CEO Richard Anderson in an effort to get him to re-consider the discounts. Anderson said that was inappropriate and sent the conversation on to his lawyer.

Because American Airlines is turning around without the merger

One justification for the merger was that American Airlines would die without it. But the company’s bankruptcy proceedings have shed debt and costs, and expanded service helped it earn $357 million in profit in the most recent quarter. Before the merger, US Airways executives worried that American’s plans to fly more planes had “potential to disrupt the new dynamic”—higher prices in a consolidated industry—and that a merger was the “lower risk alternative” to competing with a revitalized American Airlines.

All this isn’t to say that the government’s antitrust case is cut-and-dried. Some industry analysts question some of its fare analysis and American’s long-term viability. But it’s easy to see why the government was concerned enough to block the tie-up. It may allow it if the combined company agrees to surrender slots at major airports (one worry is a merged airline will control 63% of the non-stop routes in Washington’s Reagan National Airport) but some analysts think this deal is too late: After the government allowed all those other airline mergers, in its eyes this one could be the straw that breaks the consumer’s back.