The prescient economist A. Gary Shilling says US growth is going to remain slow for some time to come. In a piece for Bloomberg View yesterday, he wrote that the US is about five years into a process of deleveraging—the reduction of debt on its balance sheet—to make up for years of excess. And then came the bad news:

My forecast is for another five years of unwinding the excess borrowing by banks worldwide, U.S. consumers and many other sectors.

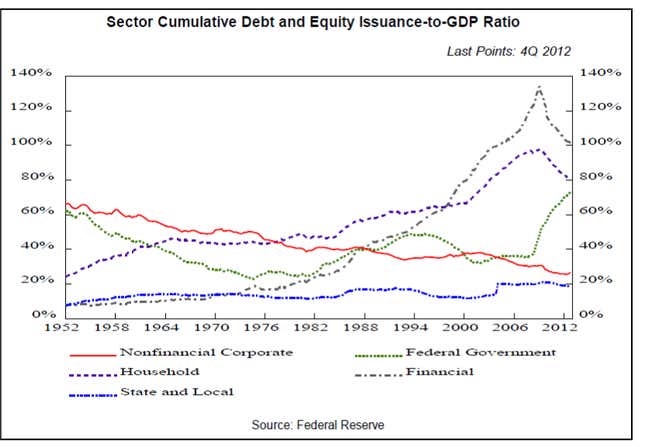

Quartz asked Schilling to quantify this further and his consultancy sent us the following graphic that shows US debt levels by sector, notably where they’ve come from, and where they are going.

Note Wall Street’s massive leveraging upward in the decades before the financial crisis. Once you see where the US was last year, it becomes clear that there’s still a ways to go.

On the reduced role of debt in an economy’s growth, Schilling writes: “…in the 1947-1952 years, each new dollar in debt in the entire economy was associated with a $4.62 increase in GDP. Recently, that figure has dropped to 9 cents because derivatives and other layers of financing do little to promote economic growth.”

Yet this same factor causes Schilling to predict that short-term pain will lead to a brighter long-term forecast where technology and innovation drive rapid growth in the US economy. Eventually, at least.