Financial markets are starting to show disquieting signs that investors are battening down for more trouble in the most important market in the world: The market for US government debt. The signs of stress stem from the inability to resolve the current government shutdown. The stalemate bodes ill for policymakers’ ability to forge a deal to raise the US debt ceiling by the end of October. And if they don’t raise the debt ceiling, it’s possible the US could default on its obligations to investors, which is not entirely unprecedented.

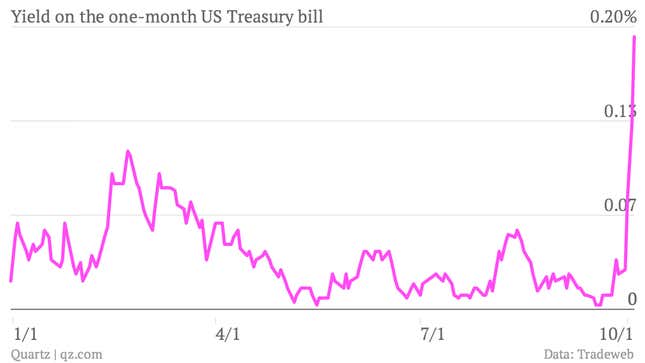

Yields on one-month US Treasury bills are spiking sharply higher as investors are trying to avoid owning these obligations, usually considered among the safest possible investments in the world. (Just as a reminder, yields and prices move in opposite directions. So when yields spike that means prices are falling.) Check it out.

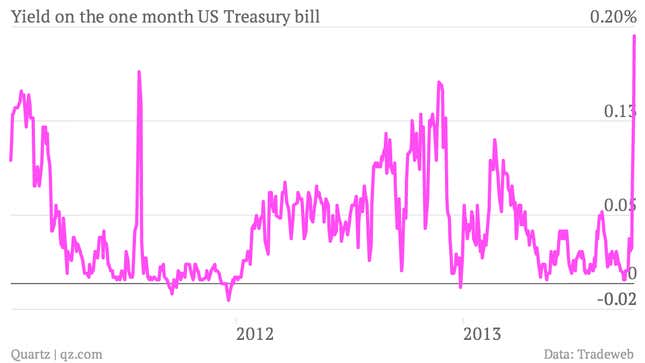

We saw a similar phenomenon back in the summer of 2011, when a fight over raising the US debt ceiling led the country to the brink of default, and ultimately led to the downgrading of the US credit rating by Standard & Poor’s. But actually, short-term yields are spiking higher now than they were back in the summer of 2011. (The anxiety over the debt ceiling fight is represented by the spike in short-term yields on the right of the chart, below, which shows a longer timeframe than above.) This is worrisome.