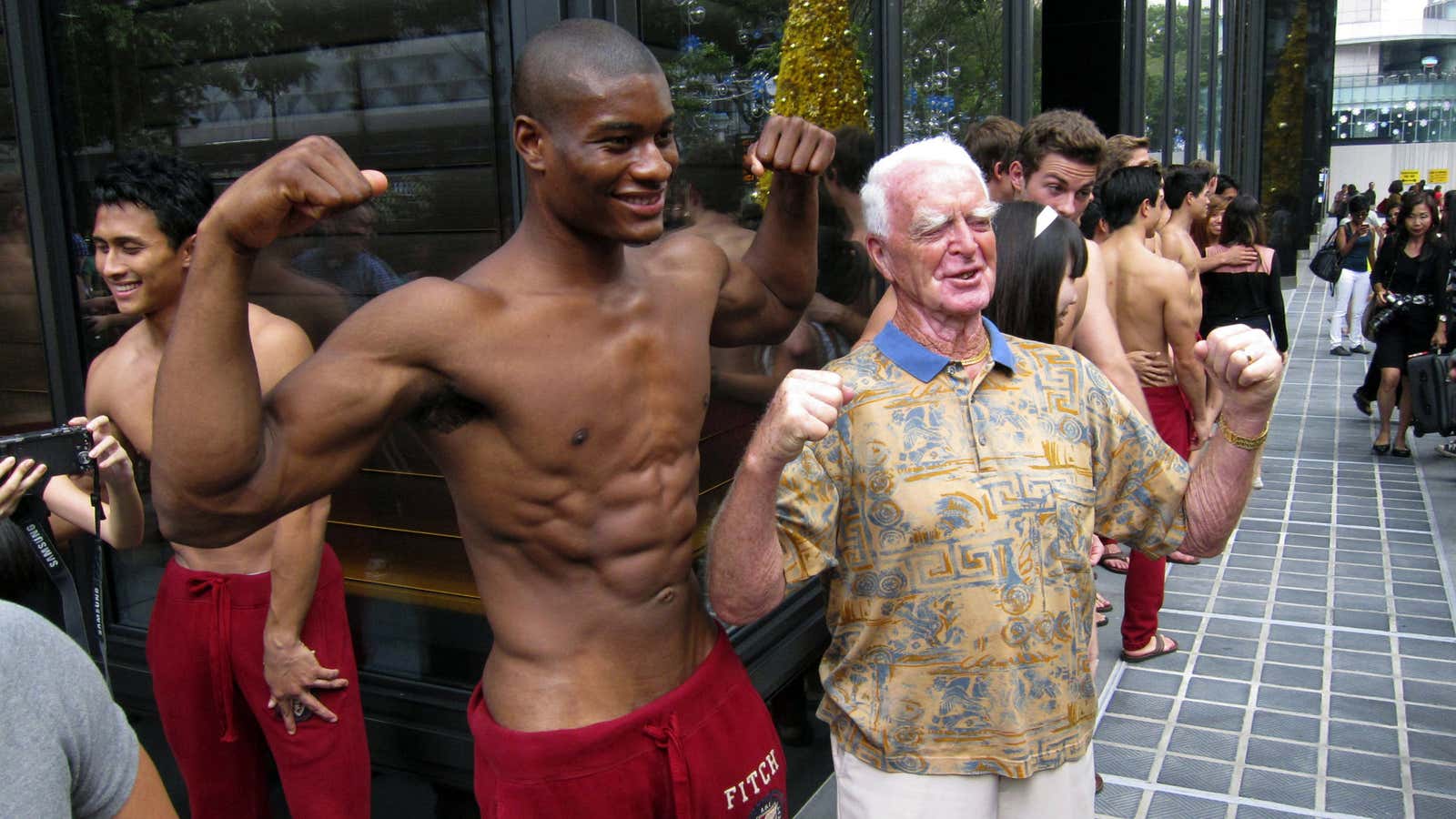

It wasn’t so long ago ago that Abercrombie and Fitch was one of the most popular, and controversial, consumer brands around. Its ads, packed with semi-clad, sometimes barely adult models, were criticized for promoting unrealistic body images and were even compared to soft porn, famously incurring the wrath of Fox News’ host Bill O’Reilly—surely the best endorsement a label aimed at teens and young adults could dream of. But now Abercrombie & Fitch is struggling for relevance as its shoppers increasingly opt for cheaper, logo-less labels like H&M, buy their clothes online, or spend on things like gadgets instead.

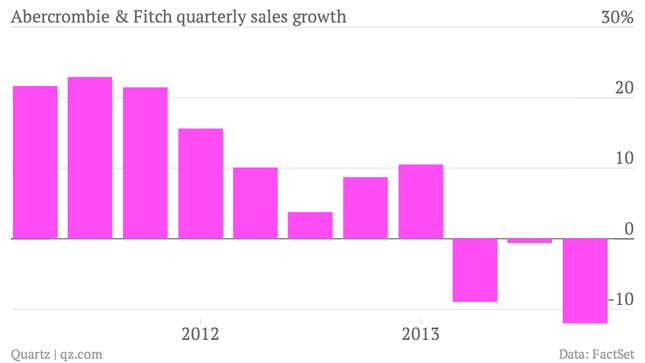

The retailer posted a 12% decline in third-quarter sales this morning, its worst percentage drop in at least 10 quarters, with a net loss of $15.6 million, compared to a profit of $84 million a year ago. Its forecast for the holiday shopping season was for another, though less dramatic, fall in sales.

Back in the glory days of the mid 2000s, Abercrombie’s CEO brazenly admitted that the company was only interested in selling its products to the cool kids, the “the attractive all-American kid with a great attitude and a lot of friends.” To this end, it didn’t stock women’s clothes above a size 10. But earlier this month, it threw in the towel and revealed that it would begin to stock “plus-size” clothing—albeit only online.

It’s not hard to understand why. The teen clothing market in the US is reckoned to be worth about $30 billion a year. The plus-size clothing market has been estimated at some $17 billion. Even as the former is moving to cheaper brands, the latter is growing. Someone at A&F has finally done the math.