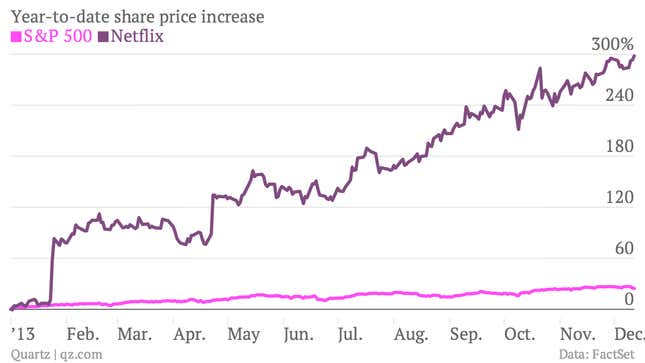

It’s clearly been a remarkable year for Netflix shares.

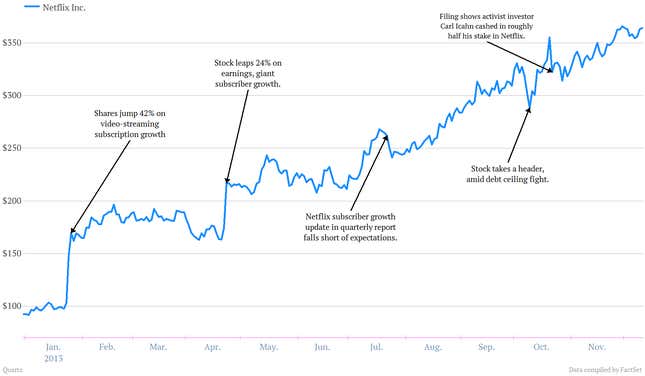

And it was largely driven by strong results released as part of quarterly earnings reports.

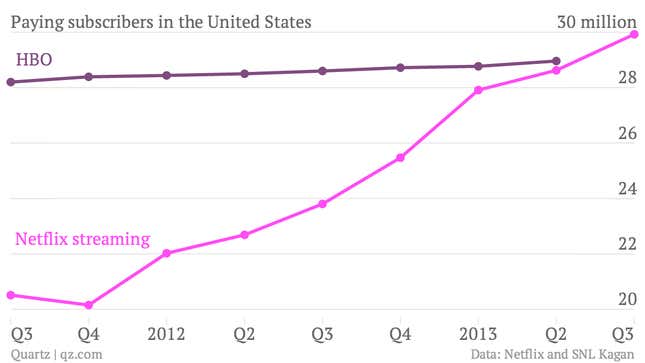

But the metric that moved the shares wasn’t profits. It was subscriber growth for its online video stream services. They’ve been on a tear. In fact, in the US Netflix now has more video streaming subscribers than HBO has subscribers of any stripe.

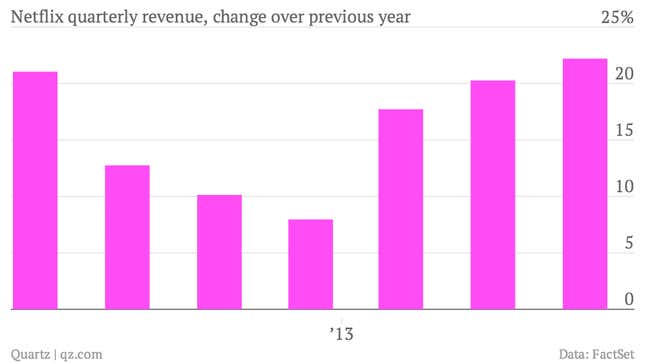

More traditional metrics also showed improvement during the year. Here’s a look at sales growth picking up steam.

Profits have been rising, too. But they aren’t nearly substantial enough to justify Netflix’s $370 share price. That’s left Netflix with a steep price-to-earnings ratio—a basic way to measure if a stock is cheap or expensive when measured against a company’s earnings. A stock is typically considered fairly valued when its price is trading around 15 times earnings. Netflix is trading at 300 times earnings.