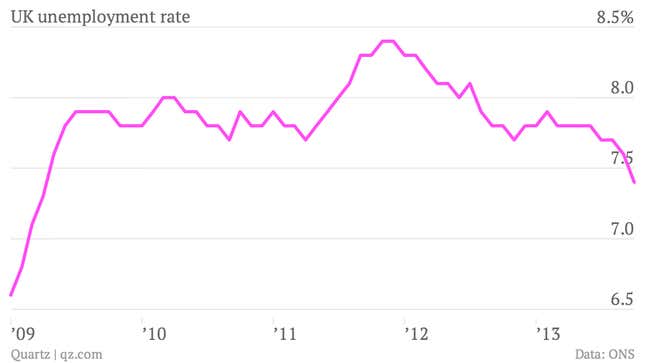

The UK’s unemployment rate dropped unexpectedly in the three months to October, to 7.4% from 7.6% in the previous release. This takes Britain’s jobless rate down to a level not seen since early 2009.

The data release was the latest in a series of pleasant economic surprises in the country. In fact, the economic news is so good that it’s starting to pose a problem for Bank of England governor Mark Carney. After taking over the helm of the bank in July Carney introduced a policy of “forward guidance,” which ties interest-rate decisions to specific levels of inflation and unemployment. The aim was to give markets a better sense of when to expect rate changes. The problem is, the data now suggest rates should go up a lot sooner than the bank’s official outlook.

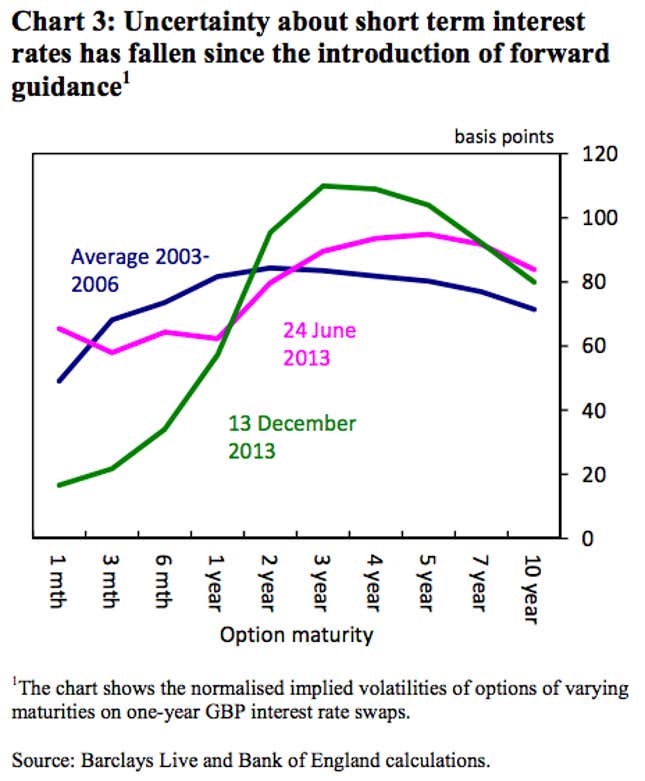

This means that even with forward guidance, the markets are none the wiser about the course of monetary policy. Material that Carney presented in testimony to parliament yesterday (pdf) proves this point. The chart below shows the volatility of interest-rate derivatives before and after the introduction of the bank’s forward-guidance policy. Volatility—a proxy for uncertainty—has fallen for instruments that look ahead for less than a year, but it is higher for almost all other maturities:

For example, the bank says that it won’t hike interest rates before unemployment falls to 7%, which it doesn’t think will happen before 2015, at the earliest. But thanks to today’s data the markets are pricing in a hike sooner rather than later, as seen by the surge in the value of the pound today.

In reality, the policy was always much more complicated than a knee-jerk response to the latest data. Vaguely defined “price stability knockouts” superseded the unemployment and inflation hurdles at the bank’s discretion. But that level of subtlety seems to have been too much for analysts (much less the media) to deal with.

And so despite the surprisingly strong job market—alongside rapidly improving economic growth—Carney is preaching caution. He noted yesterday that rates could remain at current levels for “some time after the 7% unemployment threshold is reached.” Wages are still failing to keep up with inflation, which squeezes incomes and limits spending power. In the minutes of the Bank of England’s rate-setting committee meeting earlier this month, which were published today, officials fretted about this “extremely weak” wage growth. They also warned that “any further substantial appreciation” of the pound—not unlike the move today—may pose “additional risks to the balance of demand growth and to the recovery.”

This is Carney’s challenge: Although many, if not most, of Britain’s high-profile economic indicators have been stronger than expected, there are still underlying weaknesses—wages, business lending and a burgeoning property bubble—that the markets may not be fully taking into account. And so the governor is trying to convince traders not to get ahead of themselves by pricing in imminent rate hikes—with mixed results.