Analysts who crank out stock reports and ratings for investment banks thrive on action. If the research they publish every day convinces a reader to buy or sell stocks, bonds or other instruments, chances are it will generate commissions for the bank’s trading desk, and what’s good for the bank is good for the analysts.

This impulse often inspires analysts to engage in what’s known colloquially as “fantasy M&A.” These reports discuss purported takeover targets or even fully-fledged deals between companies. Particularly persuasive ideas can take on a life of their own—moving markets, presenting awkward questions to the management of companies concerned, and maybe even drawing real dealmakers out of the woodwork.

Some notable recent reports and analyst chatter focus on an industry close to home: banking. Amidst a broader M&A mini-boom (paywall), this may be down simply to the mysterious “animal spirits” that occasionally grip the markets, or they could signal the start of something big. Judge for yourself:

Is Standard Chartered a takeover target?

Bid rumors have long circled the London-based, emerging-markets-focused bank Standard Chartered. A recent management reshuffle saw Standard Chartered’s shares stumble further; they have lost a fifth of their value over the past year. Analysts at Citi published a report this week that leads with the management turnover by way of suggesting that Standard Chartered is now definitely in play.

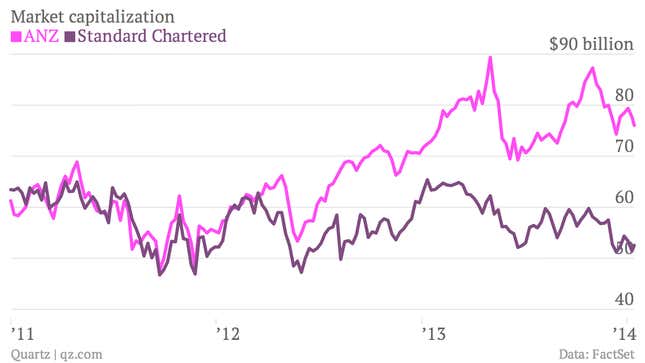

They mention Melbourne-based ANZ as a “possible but unlikely” suitor, which was enough to boost Standard Chartered’s shares a bit. (Neither bank has commented on the potential deal.) There is no doubting that ANZ would have the financial firepower to acquire Standard Chartered, given the banks’ diverging fortunes of late:

Is ANZ on the prowl in Asia?

On ANZ’s part, investors are now combing through recent comments by Mike Smith (paywall), the bank’s boss, on his aspirations in Asia, where ANZ lacks scale but Standard Chartered is strong. “I still believe that some of the European bank assets [in Asia] will have to be sold off,” Smith told the Wall Street Journal. Some may see this as proof that ANZ is eyeing some of these assets—if not the entire business—of London-based Standard Chartered.

ANZ was among a group of suitors that analysts thought would bid for Hong Kong’s Wing Hang Bank late last year, before Singapore’s OCBC emerged as Wing Hang’s preferred acquirer. That ANZ’s name has popped up in Standard Chartered takeover rumors reflects analysts’ belief that the Australian bank is eager to pull the trigger on a deal in Asia this year. With mid-sized Hong Kong banks featuring prominently in M&A watchlists, it’s a safe bet that ANZ will be a fixture of Asian takeover talk in the months ahead.

Will UBS break itself up?

Analysts have also recently made waves for UBS, the Swiss banking group. A detailed report last week from Mediobanca made the case for UBS to spin off its investment banking unit, even hinting that the bank’s management might be “dusting off plans” to do.

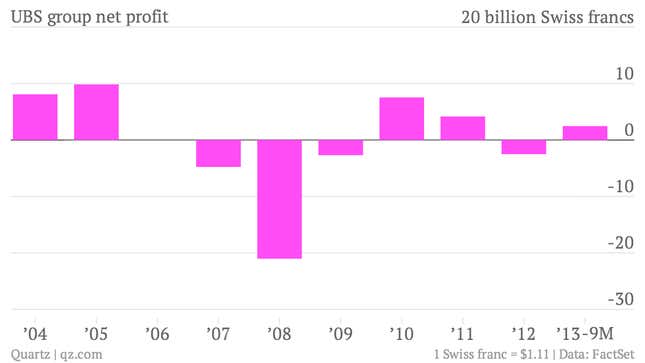

Battered by a rogue-trader scandal, Libor-manipulation fines and toxic assets acquired before the financial crisis, UBS launched a dramatic restructuring (paywall) of its investment bank in late 2012, shifting its fixed-income (e.g., bonds) trading business into a “non-core” unit that will be wound down while cutting some 10,000 jobs across the group.

UBS’s investment bank dropped out of the global top 10 in terms of fees last year, according to Thomson Reuters. It is steadily losing ground in M&A, although it retains some strength in equities and in parts of Asia. It hopes what remains of its investment bank after the restructuring will complement its larger, long-established wealth management business in Europe and, especially, Asia.

As it slims down and untangles itself from its misfiring fixed-income division, UBS’s investment bank has reported better results in recent quarters, helping push the group’s share price up by more than 70% from its nadir in mid-2012. If this is the reaction to a piecemeal dismantling of the investment bank, Mediobanca’s analysts reckon that a full-blown separation—which could include resurrecting the SG Warburg brand—would boost the bank’s value by 14% this year.

A UBS spokesperson told Quartz that the bank would normally not respond to these sorts of reports. But the Mediobanca prediction seems to have struck a chord in the markets, forcing bank executives to address the spin-off idea on several occasions over the past week. “We’ve been more than clear that our strategy includes the investment bank,” the spokesperson said.

The best of the rest

Elsewhere, analysts are busy speculating who will pick up large portfolios of shipping loans that German and British banks are expected to dump (paywall). Others are moonlighting as political pundits, speculating on the timing of potential stake sales in bailed-out banks by the Spanish government in Bankia and the British government in Lloyds Banking Group. Long-anticipated consolidation among Italian banks has been a staple of analyst reports in recent years, with talk growing louder of potential deals featuring small and medium-sized lenders in the first half of this year.

The notion that many banks still need to deleverage and recapitalize to meet increasingly strict standards set by jittery regulators, particularly in Europe, underlies many of these and other transaction rumors, particularly the ones that still exist only in analyst chatter instead of published reports. By some estimates, hundreds of billions of dollars worth of assets will be offloaded by Europe-based banks in the coming quarters (hence ANZ’s hope that there’ll be something to buy). Depressed valuations among industry laggards also provide rich pickings for banks with the resources to snap up competitors on the cheap.

Whatever happens in terms of actual deals, the conditions seem favorable for a burst of financial sector M&A. That’s good news for the analysts who earn their keep guessing the identity of the next deal in the pipeline, whether real or imagined.