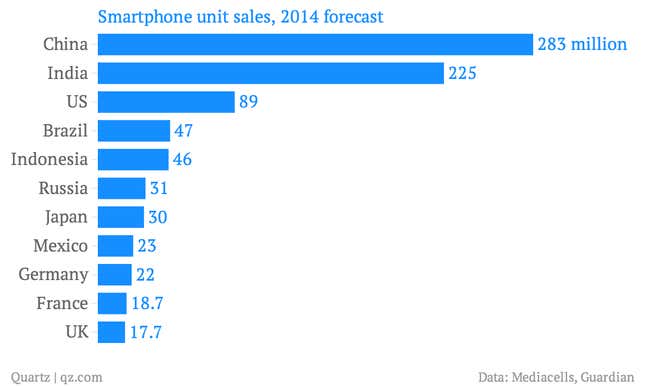

The short answer: India will be, after China, the single largest market for smartphone sales in 2014, according to a recent forecast.

The slightly longer answer: Hewlett-Packard has what some might call the last-mover advantage. It had a rocky start in the mobile sector, acquiring one-time personal-digital-assistant leader Palm in 2010 to boost its mobile efforts, only to shut down its phone and tablet units in 2011. Though HP chief Meg Whitman promised a re-entry in the smartphone market as far back as Sept. 2012, the company’s absence from the market has given it plenty of time to figure out what works and what gaps in the market it can exploit.

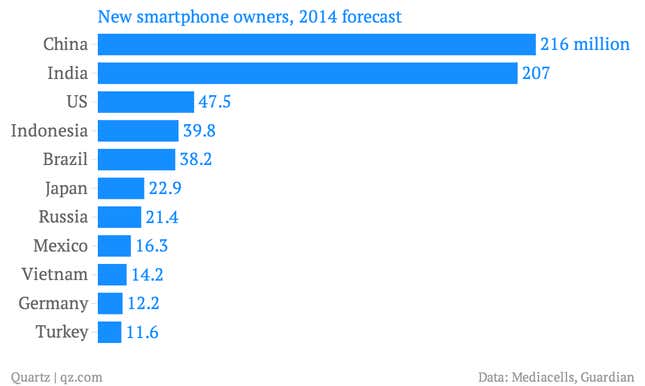

The sweet spot turns out to be a very specific one. According to figures provided to the Guardian by Mediacell, a research company, 92% of those smartphones sold in India will be to first-time buyers, compared to just over half in the US. The strategy is similar to Microsoft/Nokia’s: hook ’em early and keep ’em coming.

The phablet gambit: HP is also calculating that new smartphone owners who have splashed out a substantial amount of cash will be in no mood to go buy another expensive device in the form of a tablet. That has been part of the reason for the rise of the unfortunately named “phablets.” So both of the newly announced HP phones, set to go on sale in February, are firmly in the phablet category, at 6 and 7 inches. Indeed, they’re branded “VoiceTab,” for tablets with voice capability: These aren’t phones that can be used as tablets, they’re tablets that also make phone calls.

Other nods to the needs of emerging markets include dual-sim capability, a popular feature in countries where pre-paid connections dominate and consumers routinely have two or more connections to take advantage of different price structure on different networks, and a focus on sound and speakers, a big plus for a nation that is fond of blaring Bollywood music in public.

Pricing is everything: HP still has to convince Indians that they want an HP phone. Samsung and Micromax, a home-grown company, are clear leaders and other domestic brands such as Karbonn are also gaining in popularity. A lot will depend on HP’s pricing in a notoriously price-sensitive market. The press release suggests the phones will be “great value,” but anything over $250 will be a hard sell for a new entrant. But at least the structure of the market allows for this sort of thing: In a country where telecom operators don’t as a rule sell mobile phones on contract, consumers are free to buy whatever phone they wish.

The out-of-town tryout: Still, there’s one more benefit to launching in India. If it bombs there, HP can go back to the drawing board or try other markets. But if it launches and fails in its home market in the United States, that effectively kills the product in the eyes of customers and investors. Nobody wants to buy something they perceive as an inferior hand-me-down. No wonder, as TechCrunch points out, India has long been a test-bed for HP’s more outlandish products.