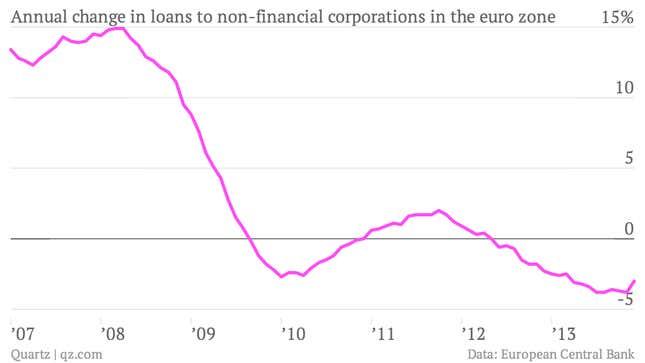

The euro zone’s credit crunch grinds on. The European Central Bank’s latest data on bank lending, updated yesterday with numbers for December, paint a sorry picture for businesses. On a year-over-year basis, business loans have shrunk in 30 of the past 48 months.

The ECB is trying to look on the bright side of this. On the whole, its says in a survey of senior loan officers (pdf) published today, banks are reporting that their credit standards for businesses—how easy it is to get a loan and the conditions for paying it off—are getting more stringent, but not by as much as in previous quarters. Demand for loans continues to decline, but at a slower pace than before. And in this coming quarter, banks are telling the ECB, things will get even better: There will be a “complete halt” to tighter lending standards, and loan demand will rise.

However, the banks’ recent predictions have proved too optimistic. They expected looser standards and higher demand last quarter, when the opposite was actually the case. And there are other reasons to expect lending is not about to get better. This year, the ECB will conduct a comprehensive stress test of the euro zone’s largest banks. The exercise is likely to find a “substantial lack of capital” at banks, both in the stronger “core” countries as well as in the wobbly “periphery.” Ahead of this examination, banks are conserving their capital, shedding unwanted assets, and raising new equity, lest they are forced into more drastic actions by a disapproving ECB. A big expansion of business lending is probably not high on their list of priorities.

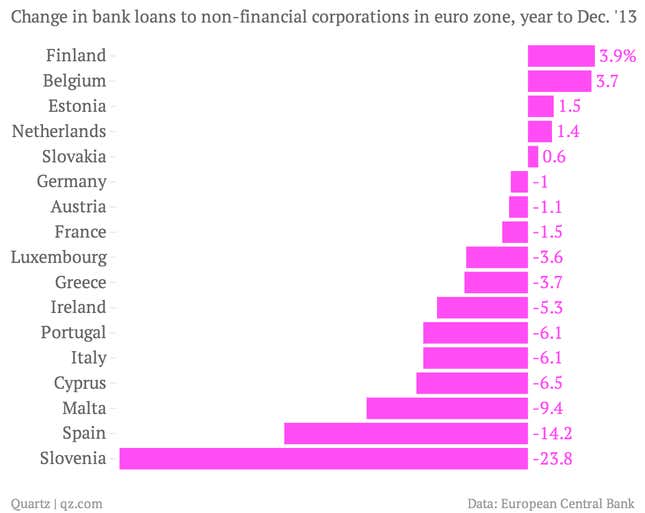

In fact, looking at the country-by-country details for lending in December, the scarcity of business credit across the euro zone is striking. And pity the poor Slovenian firms looking for a loan; in the month when the country’s biggest banks were bailed out by the state, lending plunged by 24%. With the Slovenian central bank chief warning that things could get worse before they get better, the sorry state of lending in other countries, however grim, looks quite cheerful by comparison.