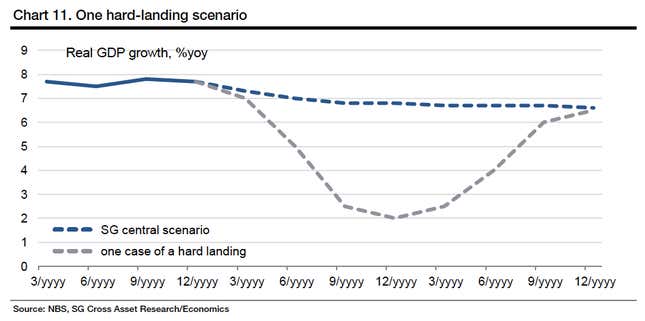

People murmur darkly about a “Chinese hard landing.” But what does that really mean? Société Générale is kind enough to explain that in a report out today that imagines a scenario in which China’s GDP growth falls to 3.8% in 2014, bottoming out at an annualized 2% for two quarters, and shaves as much as 1.5 percentage points off global GDP growth that same year.

Mind you, that’s not likely; SocGen thinks China’s more likely to grow 6.9% in 2014. But since it’s “a very real possibility,” as Yao Wei, SocGen’s China economist, writes, it’s worth following SocGen through its thought experiment. Before we get to that, though, there’s the question: What could cause such an apocalyptic slowdown in China?

The Chinese government is, at least in theory, trying to deflate a credit bubble while also instituting market reforms that will help the economy grow more sustainably. However, “China could be more vulnerable to a systemic shock than even the authorities realize,” writes Yao. If the government loses control over this delicate process, any number of events could trigger widespread corporate bankruptcies. Investment, which constitutes around half of China’s GDP, would contract, dragging growth with it.

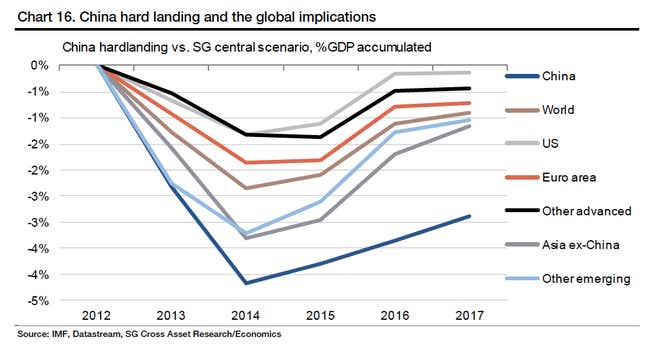

The most immediate global impact of a Chinese hard landing would be to kill demand for commodities and machine tools, which China’s investment binge currently drives. For instance, SocGen’s commodity strategist projects a 30% drop in oil prices. Plummeting imports would hit Asian countries and commodity exporters the most—notably, Taiwan, South Korea, Malaysia, Australia and Mongolia.

Perhaps one of the biggest blows to global GDP would be psychological. SocGen highlights that because this would all unfold at a time when the global economy is on shaky ground and central bankers have exhausted their policy arsenal, “uncertainty shock” would cause corporates all over the world to suspend investment and hiring. That alone would shave 1% off global GDP.

This would also cause a “severe shock to the appetite” for emerging-market assets. SocGen highlights that the South African rand, Russian ruble and the Chilean peso would lose value. Volatile Asian currencies like the rupee and rupiah would suffer too. Yields on government bonds in India and several Southeast Asian economies would jump.

But it’s not just emerging markets or commodity hubs that would take a hit. Since a Chinese hard landing would sap global economic growth, it would make fiscal adjustments in the euro zone even more difficult, prompting more sovereign ratings downgrades.

As the impact set in, capital would flee China—and Asia more generally—into cozy dollar-denominated assets, particularly US bonds. However, that wouldn’t be great for US imports since it would pump up the value of the dollar by 10%, even assuming the Federal Reserve undertakes more quantitative easing.

It’s not all grim, however. Lower commodity prices would offset some of the impact from China’s cratering, cushioning the blow to global GDP. And if the Chinese government could resist stimulating growth with loose credit, a hard landing would actually accelerate market reforms, says Yao. That would put China on the path to sustainable long-term growth much faster than the current, albeit stabler, pace of change.