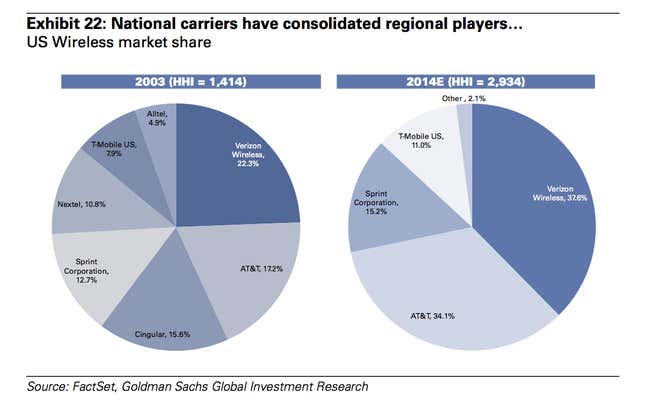

It should be no surprise that there are increasingly few real players in the US wireless business. Goldman Sachs makes the point clearly in this chart, which it recently published as part of a note on trends in mergers and acquisitions.

While potentially good for shareholders, the emergence of such oligopolies is typically bad news for consumers. A major rationale behind such combinations is to provide a boost to “pricing power.” But as Goldman Sachs analysts note, the US wireless industry hasn’t really been able to use prices to push profit margins higher, despite its highly consolidated nature. Goldman analysts write:

It is arguable that the industry has in fact become more competitive for the industry’s top two companies, as #3 and #4 players Sprint and T-Mobile have strengthened their competing nationwide networks with ongoing buildouts and spectrum acquisitions (i.e., T-Mobile’s acquisition of MetroPCS and Sprint’s acquisition of Clearwire). This has enabled them to be more competitive vs. Verizon and AT&T in key urban markets than previously, a dynamic that could continue to keep a lid on industry margins near term despite a very high level of consolidation.

In other words, the only thing standing between you and the pricing power of an increasingly oligopolistic wireless industry in the US is the aggressive pricing model being pushed by upstarts such as T-Mobile chief John Legere. T-Mobile’s bid to capture market share through aggressive pricing strategy has enabled it to pick off a growing number of subscribers in recent months.