Bern’s Steak House, a family-owned Tampa fixture for decades, recently opened a boutique hotel to honor the legacy of founder Bern Laxer that includes culinary classes, a patisserie and fork-and-knife-adorned pillows. Originally floated in 2003, the project was shelved after the real estate market crashed in 2008, but current developer Mainsail Lodging is relying on a novel kind of funding—cash from foreigners hoping to become US residents.

It’s well known that China’s wealthy investors are stashing money abroad in real estate and offshore bank accounts. But their investment in US small and mid-sized businesses, thanks to America’s immigrant investor program known as the EB-5 visa, is rapidly growing. The visa gives foreigners who invest least $500,000 in the US a two-year green card (their families too) and the potential for a permanent green card if their project succeeds in creating American jobs.

Vermont’s Trapp Family Lodge (yes, it is associated with the Sound of Music family) is advertising on its website that it is looking for EB-5 investors to open a beer hall. Bill Stenger, the chief executive of Jay Peak ski resort in Vermont has attracted 600 investors and $275 million in the past seven years into his hospitality business through the EB-5 program, he recently told The Straits Times. VooDoo BBQ, a New Orleans restaurant chain, recently expanded to South Florida, thanks to $5 million in EB-5 funding, and is now raising a second round of cash.

For many small to mid-sized US businesses, the EB-5 program fills a gap left after credit dried up in recent years. Despite almost $200 billion in government bailout money given to the US banking industry after it created the global financial crisis of 2008, loans to US small businesses declined by 27% from June 2008 until June of last year. EB-5 funding is not just more available, it’s cheaper: hotel developers promise EB-5 investors returns of 4% or less, versus at least a 6% interest rate on bank loans, Dealbook reported.

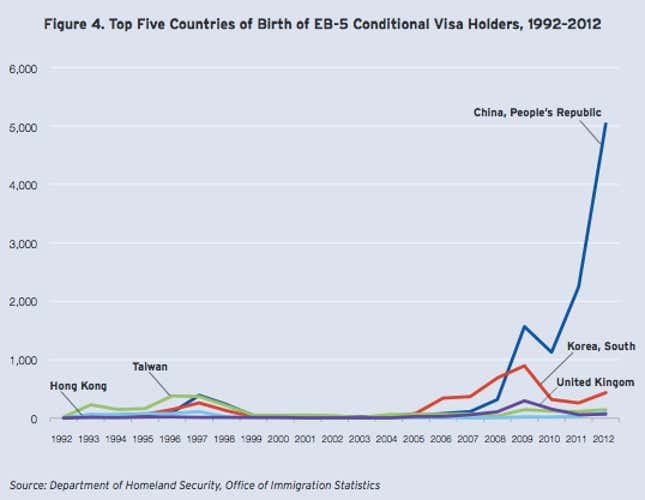

Since it started in 2005, the EB-5 visa program has brought $6.7 billion into the US, most of that in recent years, and created 95,000 jobs, the Association to Invest in USA estimates. Chinese investors dominate, as this chart from the Brookings Institution and Rockefeller Foundation shows:

The fast growth in the US’s EB-5 visa program has raised questions about the program’s effectiveness and oversight. The increased potential for scams is another concern. Critics say that the projects, often restaurant and hospitality ventures, are so risky that most American’s won’t invest in them.

Still, even more US businesses may soon be getting a cash infusion from Chinese investors. The Canadian government’s recent decision to scrap its own immigrant investor program under the weight of Chinese applications has left 46,000 Chinese investors searching for a new home for their cash as well as their families. Many are likely to turn to the US.