Why US homebuyers shouldn’t panic about a growing flood of Chinese overseas investment

Wealthy Chinese have been snapping up overseas real estate and foreign stocks of late. And this year that spending is set to grow another 30%, says a recent report by Bain & Company and China Merchants Bank.

Wealthy Chinese have been snapping up overseas real estate and foreign stocks of late. And this year that spending is set to grow another 30%, says a recent report by Bain & Company and China Merchants Bank.

A lot of that’ll be flowing into US housing, if the last few years are any guide. Chinese investors bought $8.2 billion worth of US homes (pdf) from April 2012 to March 2013, says the National Association of Realtors. That pushed China’s share of international investment in US housing up to 12%, from 11% the year before. For the third straight year, that makes China the biggest foreign investor in US homes after Canada, which bought 23% (pdf) according to NAR (pdf).

What’s more, Chinese buy more expensive homes, on average, than other foreigners—and pay mostly in cash. Some fear that’s going to push US home prices up out of Americans’ reach.

Nor are they buying just homes. As the Wall Street Journal reported recently, it’s everything from office buildings to retail space, everywhere from Oakland to Toledo (paywall). ”The buyers are typically a husband and wife who don’t speak English. They come in a brand-new BMW or Mercedes and visit the site for five minutes,” Elliot Medoff, a broker in the real estate company Cushman Wakefield, told the Journal. “They don’t ask questions, there’s no due diligence, they pay cash.”

China’s own attitude isn’t helping quell the fears about a property-market invasion. Noting that 69% of Chinese buyers pay in cash, China’s state-run press crowed, “this would stun Americans” (link in Chinese), many of whom “have had their homes confiscated because they couldn’t pay their mortgages.” (It neglected to note that few US banks will give Chinese buyers mortgages.)

But American fears are overblown, for a couple of reasons.

First, even though overall Chinese investment abroad is climbing, their investment in US property specifically is shrinking. The $8.2 billion Chinese buyers spent in the 12 months to March 2013 is 10% less than it was for the previous 12 months, even though US housing prices have since climbed. Plus, Chinese purchases represent less than 1% (link in Chinese) of the US’s total residential real-estate market, notes Caixin.

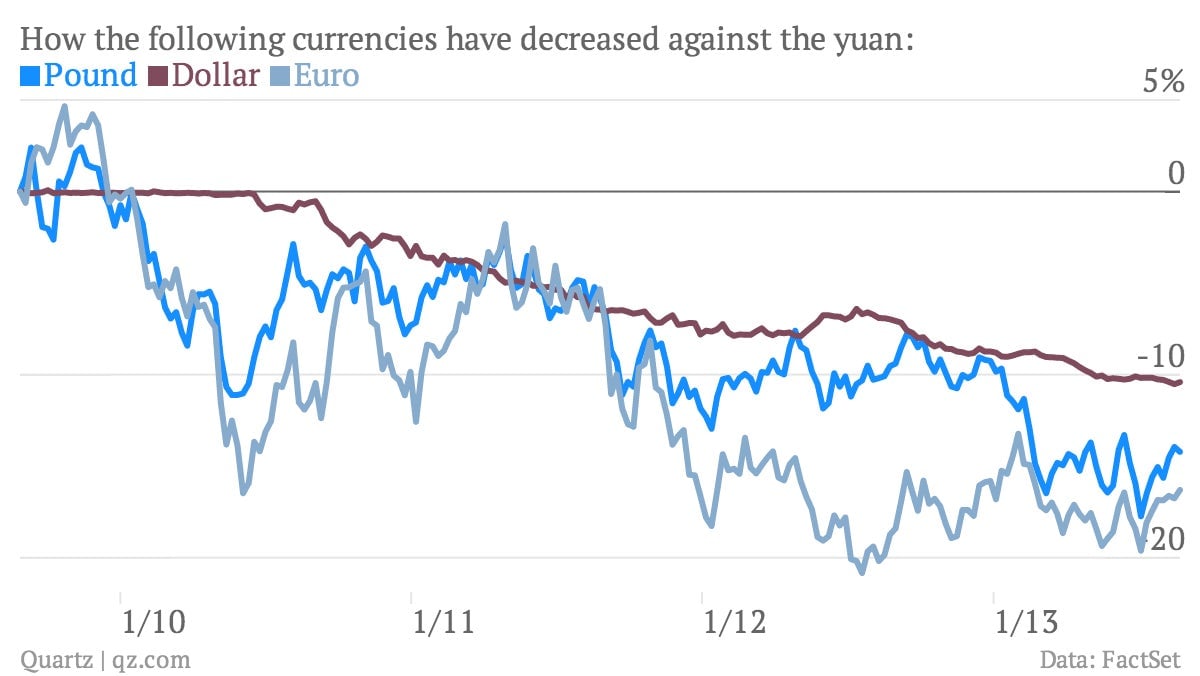

Finally, there’s the impact of currency. Since the yuan is loosely pegged to the US dollar, when the dollar strengthens against the euro or pound sterling, the yuan does too, making property in Europe more affordable to the Chinese. The yuan has gained more against the pound and the euro over the last few years than it has against the dollar—and that’s even as US monetary policy weakened the dollar:

If the dollar continues to strengthen, properties in Europe and the UK will be even more appealing to Chinese buyers. That’s a worry for prospective London homebuyers, perhaps. But probably less so for US ones.