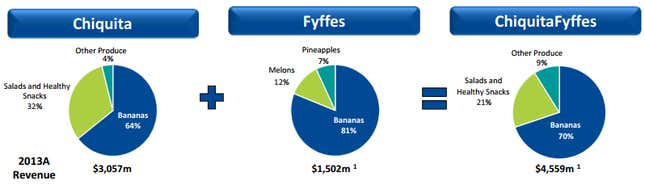

On the face of it, Chiquita’s proposed merger with fellow banana giant, Fyffes, makes sense a lot of sense. Since he took over as Chiquita’s CEO in October 2012, Ed Longergan has aggressively reversed the company’s money-losing diversification strategy, vowing instead to concentrate on bananas and salads. The merger seems to help with that; some 71% of the new company’s sales will come from bananas, compared with 65% of Chiquita’s.

But look at it another way, and you see the deal boosting its “other produce category” from the current 4% to 9%—a funny move for a company dead-set on un-diversifying. Assuming the new company passes antitrust muster, a lot of ChiquitaFyffes’ new non-banana business will come from melons and pineapples, in which Fyffes has been investing pretty heavily (pdf, p.19).

Why would Chiquita be reversing course, abandoning the diversification strategy that saw it shed grape and avocado production?

For one thing, both melons and pineapples are proving promising for Fyffes. The company’s melon business focuses on the US, where sales have more than doubled since 2008, and it became the top melon-seller in 2011. As for pineapples, while its sales trail those of Fresh Del Monte and Dole in both Europe and the US, Fyffes’ share has been steadily increasing. Neither division would be easily sold off. Fyffes has invested heavily in expanding cultivation of both types of fruit in Latin America; its now grows all of its melons and 56% of its pineapples there.

But another reason might be the rising risk that banana diseases pose to the industry. We recently discussed how an invincible fungus called Panama disease will inevitably threaten banana plantations in Latin America, where the vast majority of export bananas are grown. A more immediate menace is Black Sigatoka, a disease that typically causes losses of 50%-80% of any crop it strikes and is already a severe problem in a slew of Latin American countries. That disease and others force growers to use more pesticides, causing a sharp spike in costs. The growing torrents of chemicals that farmers have to pour on their banana crops is also upping concerns about environmental destruction and harm to workers.

One other thing to note is that Chiquita is not in great financial shape; as of Aug. 2013, its $602 million in total debt was the second-highest relative to earnings among 32 similar packaged-food and meat companies in the US, reports Bloomberg. Which is why it’s interesting that, despite the fact that Chiquita is much bigger than Fyffes, the new company will be based in Ireland, Fyffes’ home country, rather than Chiquita’s home, the US. As Quartz’s Tim Fernholz recently noted, Ireland has an incredibly low corporate tax rate. And for Chiquita, a company struggling to up its cash flow, that certainly can’t hurt.