The US Federal Reserve has been pushing down interest rates to unprecedented levels through repetitive rounds of quantitative easing (QE). The motive? Help the housing market and stimulate employment. But while we’ve shown that QE is working to generate a housing recovery, unemployment remains stubbornly high at 7.8%. And yet the US stock market is up 12.4% since the start of the year.

That’s probably because companies aren’t investing the money they can (thanks to QE) borrow cheaply in expanding their workforces or increasing production. They’re using it to buy back their own shares. That keeps their stock prices up. Jefferies Chief Global Equity Analyst Sean Darby argues that these stock buybacks are keeping the equity markets artificially high (my emphasis):

Ironically, the equity markets are being squeezed higher as the free-floats are reduced on buybacks despite a lackluster earnings season to date. This trend can continue until either corporate bond spreads widen or companies feel the urge to spend again. Until then, the performance of the equity markets and the real economy will continue to diverge. To date, global investors are appearing to reward equity markets where cash-flow is strong such as in the US in contrast to many emerging markets where cash-flows remain under pressure.

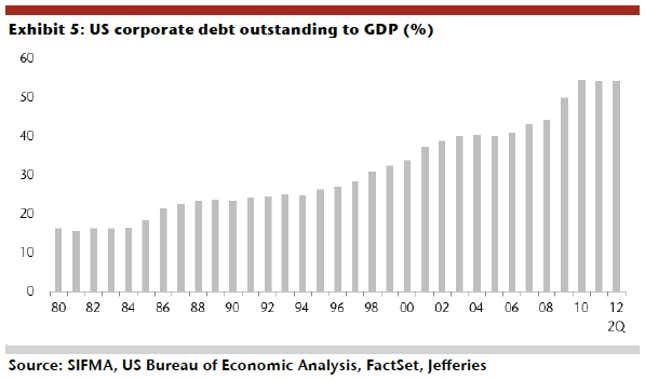

On one hand, companies are borrowing at a very high rate versus GDP because interest rates are so low:

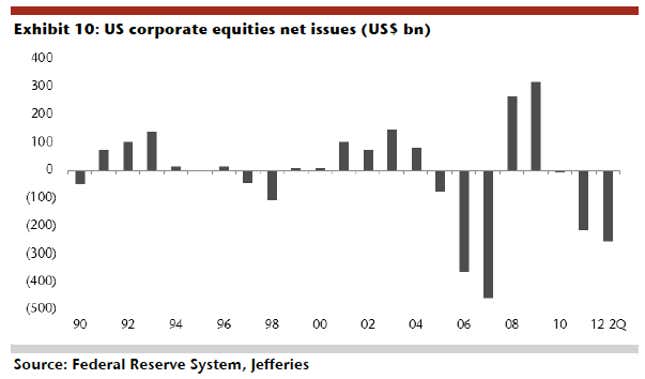

And the amount of equity issued minus the amount of debt repurchased (the net equities issued) is shrinking by the largest value since 2007. Companies are on their way to repurchasing $300 billion of their own shares in 2012: