On its face, the retirement of Tim Fenton as chief operating officer (COO) at McDonald’s was a pretty routine corporate announcement. Executives come and go every day in the corporate world, and ill health forced Fenton (pictured above), after 41 years at the fast-food giant, to announce he was calling time on the globe-trotting lifestyle of a multinational manager this week.

But Fenton’s departure also carries symbolic importance. McDonald’s will not replace him, scrapping the COO position and divvying up its duties among other executives.

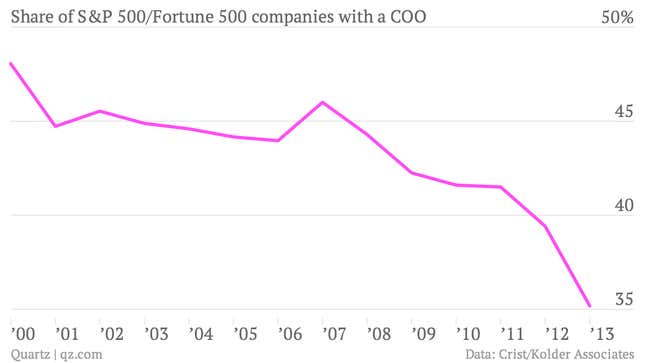

The COO is an increasingly endangered species in corporate boardrooms. Once the de facto second-in-command, only around a third of large listed firms in the US now have a COO:

The main beneficiary of the COO’s decline has been the chief financial officer (CFO). At McDonald’s, CFO Pete Bensen will take over the outgoing COO’s responsibilities for the company’s supply chain, development, and franchising operations. Finance chiefs have been absorbing more operational duties for some time, typically as a test of their abilities to take over as chief executive some day.

In my research for a book about the role of the CFO, I looked at the backgrounds of finance chiefs at 200 of the world’s largest listed companies. Around 15% of them ran a business unit or had other high-level operational responsibilities on top of their CFO duties.

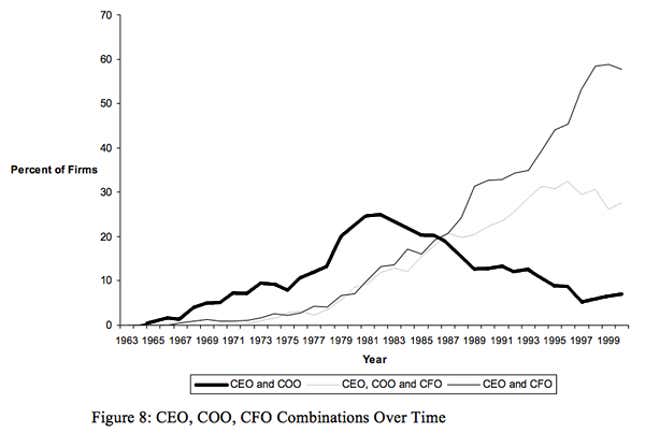

When GE did away with its group-level COO role, in 1983, the writing was already on the wall. The responsibility for day-to-day operations was steadily pushed down to divisional presidents, while the importance of financial markets thrust the CFO to fore. The sprawling industrial conglomerates that competed on their manufacturing prowess made way for leaner companies, propelled by the booming corporate bond market and forced to focus by increasingly aggressive private equity firms.

In this environment, the ideal top executive team paired the CEO not with a COO but a CFO, who assessed the company’s various divisions like a portfolio manager would. A 2005 study by academics at Harvard, Princeton, and the University of British Columbia traced this evolution at large American companies:

In the mid-1980s, only half of these companies even named a CFO, according to another academic study (pdf). The position is ubiquitous today, thanks in part to finance chiefs taking on many of the duties once assigned to the COO. Each new announcement of a COO’s departure, more often that not, reinforces this trend.