How CFOs took over the boardroom

From back-office accountant to front-line executive, the rapid rise of the chief financial officer is unrivalled by any other corporate role. With access to every facet of the business, CFOs now wield a level of influence matched only by chief executives. From the pervasive influence of financial markets to the growth of data-driven decision-making, at each step in the evolution of the modern corporation the chief financial officer’s skill set has proved uniquely in tune with the times.

From back-office accountant to front-line executive, the rapid rise of the chief financial officer is unrivalled by any other corporate role. With access to every facet of the business, CFOs now wield a level of influence matched only by chief executives. From the pervasive influence of financial markets to the growth of data-driven decision-making, at each step in the evolution of the modern corporation the chief financial officer’s skill set has proved uniquely in tune with the times.

The breadth of experience that chief financial officers gain on their way to the top makes them an increasingly sought after commodity for a host of roles outside of the finance department. More than half of externally recruited CFOs at the largest companies in the United States are appointed from a company in a different industry, a sign of their versatility. Only a quarter of CEOs appointed from the outside are poached from a different sector. The number of CFOs promoted to CEO continues to rise, often after a rotation through a regional or divisional general manager position. Former finance chiefs are fixtures in many boardrooms as non-executive directors.

And so the odds that a senior executive spent time in the finance function on the way up the corporate ladder are rising. Thus the CFO’s methodical, data-driven approach to decision-making is gaining proponents over the archaic “gut feel” school of management. “Number cruncher” was once considered an insult, but as the volume and velocity of data expand exponentially it is becoming a badge of honor, as companies seeking to harness the insights within the data will inevitably turn to their CFOs for guidance, boosting their status even further.

What does the future hold for CFOs? Finance chiefs these days are more forthcoming about their career ambitions, not least because the media and investors now take great interest in their aspirations, given how integral they are to a company’s success.

Up and away

“Today I’m relatively indifferent whether I do a finance role or a commercial role,” says Jim Buckle, CFO of UK-based online sports retailer Wiggle. “It’s about finding interesting opportunities at interesting businesses.” Many young accountants, auditors or controllers just starting out see CFO as the pinnacle of achievement on the corporate finance ladder. “They go into their career thinking of it as a destination, but what happens is that there are more opportunities post that destination than there once were,” says Suzzane Wood of recruitment firm Russell Reynolds.

In most surveys, between a quarter and a third of CFOs say that they aspire to a position outside finance for their next move. Among this group, it should be no surprise that the most popular destination is CEO, particularly among younger finance chiefs and those in North America. This ambition is something headhunter Nick Aitchison sees when recruiting for CFO posts: “I’ve had CFO searches where for the person we wanted we were in competition not with other CFO roles but with CEO roles,” he says. Another recruiter, Wolfgang Schmidt-Soelch of Korn/Ferry, notes that the ranks of future CEOs among the current crop of CFOs are probably larger than the surveys suggest:

CFO candidates still view the step up to CEO as less of an option than other business leaders. They are probably more humble and realistic in their expectations. Regional or divisional heads would automatically aim for the top job. CFOs are absolutely aware that they are probably viewed as a successor—in fact, they are in a better position than some other leaders.

This describes Denise Ramos at ITT. As CFO of the industrial conglomerate since 2007, the chief executive post “was not in my sights, to be honest with you,” she recalls. But when the subject was broached in 2011, “it sounded intriguing,” she says. “To some degree, I had been thinking like that my entire career. CFOs need to understand that they should always think like a CEO.”

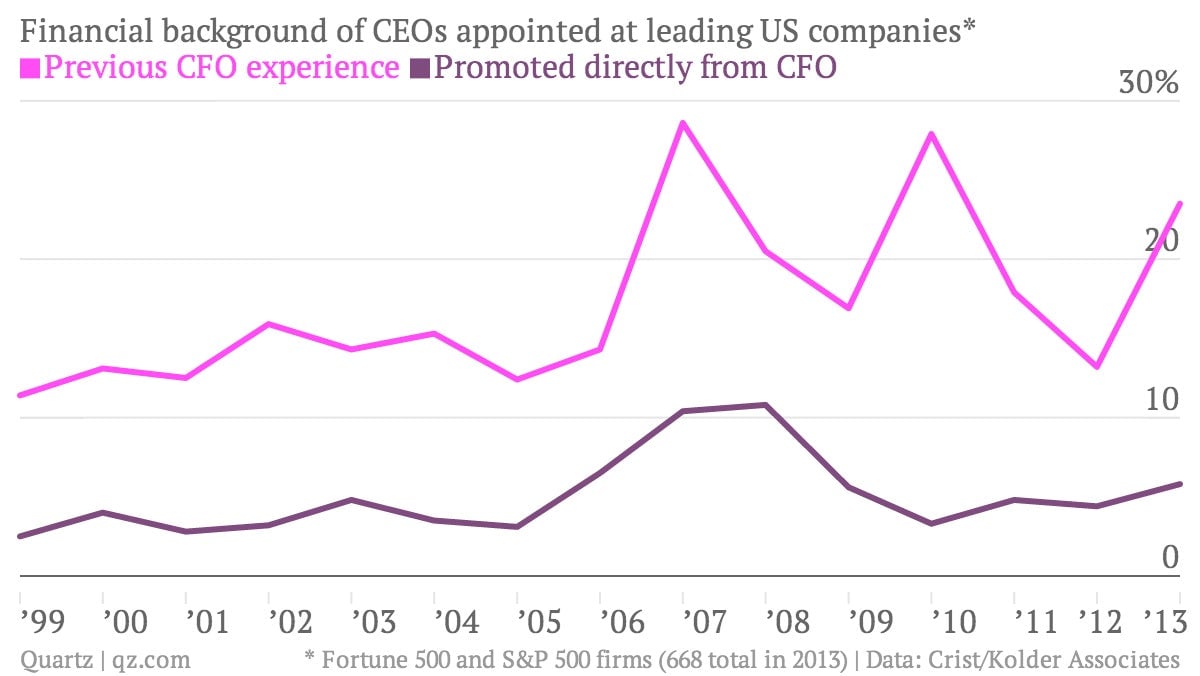

Ramos remains rare in the sense that direct promotions from CFO to CEO are not too common. That said, the share of CEOs with finance experience is sizeable; around a quarter of chief executives appointed in 2013 at the United States’s largest listed firms were once CFOs. Around half of chief executives appointed in 2012 and 2013 in the UK’s FTSE 100 have a finance background, with 12% promoted directly from CFO, according to recruitment firm Robert Half.

Companies undertaking big restructuring projects or with similar heavy financial commitments are particularly inclined to promote a CFO to the top job. For example, Marcel Smits was promoted from finance chief to CEO at Sara Lee, a US consumer products company, in 2011. In a year as chief executive he rationalized the company’s product portfolio and, ultimately, oversaw a split of the company in two. While CFO at ITT, Ramos helped develop a plan to spin off the group’s water and defense businesses. When the “new” ITT was unveiled following the divestments—now focused on the energy, transport and industrial markets—she was tapped as CEO.

Branching out

At one time, chief financial officers approaching retirement age looked forward to a pension topped up by a few low-intensity non-executive directorships, working for only a few days a month. But the demand for finance chiefs on boards these days is so strong that CFOs are given directorships much earlier in their careers, often within a year or two of assuming the CFO role. This gives them more “runway” to aim for chairman roles, says Wood of Russell Reynolds. In some ways, she adds, CFOs are better suited to jump directly to chairman instead of chief executive roles anyway:

In a chairman role, you look for somebody who’s prudent with a low ego, good judgment and is a facilitator. The low-ego, second- in-command nature of a CFO sits very well for the non-executive chairman brief. We’ve had CFOs in their early 50s make the move into chairmanship.

There are much fewer examples of CFO-to-chairman moves than CFO-to-CEO moves, but this seems likely to change in the near future. When Andrew Higginson, a long-time finance chief of Tesco, a retailer, left the group in 2012 he took on two chairmanships, at N Brown, a listed fashion group, and Poundland, a private equity- owned retailer. “[Finance directors] make quite good chairmen, better than chief executives,” he told Financial Director magazine.

There are plenty of other options for finance chiefs looking beyond the traditional CFO, CEO and director roles. State-owned companies and sovereign wealth funds in emerging markets are plucking financial talent from the West as they grow in stature and expand globally. The non-profit sector has also seen an influx of former private-sector CFOs applying their know-how to charitable organizations that are increasingly adopting more commercial approaches to managing their resources and delivering services. Private equity firms are also keen on hiring finance chiefs, both to help their funds vet potential investments and to parachute them into portfolio companies on short-term assignments. In a similar vein, another growing industry is interim finance placements and project-based consulting.

But why choose just one thing? Seamus Keating is doing a bit of everything discussed above. After 24 years rising through the ranks in the technology sector, which included eight years as CFO and two as a regional business unit head at Logica, he shifted to a new phase in his career in 2012, just ahead of his 50th birthday. He has taken on a handful of directorships, including chairman at a financial technology firm in Dublin and audit committee head at a hospital group in Abu Dhabi. In addition, he advises technology-focused private equity firms on potential investments and serves as a mentor for first-time CFOs via Merryck & Company, a London-based leadership and executive coaching firm. “Rather than just looking at the next three years, I’m thinking about what will keep me interested for the next 20 years,” he says.

Omniscient and omnipresent

As should now be clear, the responsibilities heaped on finance executives—and the financial acumen firms demand from all employees, not just those in the finance department—are reshaping the way that companies work.

Finance managers are exposed to a wider range of activities earlier in their careers and, as a result, enjoy an influence that extends further than ever before. The upshot is that, for many, CFO is now a step on the career ladder instead of its apex. Bernardo Mingrone, appointed CFO of Italy’s third-largest bank, Monte dei Paschi di Siena, a couple of years before turning 40, is clear about his career goals:

My ultimate ambition is not being CFO of a large institution. I would like to be a CEO or a general manager. Having gained the commercial experience in investment banking—you are effectively a salesperson—I’m now completing the course of my career with technical skills like greater accounting knowledge, tax planning and treasury management.

The churn in top finance posts also means that it is increasingly common for managers who spend the bulk of their careers in corporate finance to pass a decade or more at the pinnacle of the profession by the time they turn 50. The impatient, results-oriented view of performance may push them from the CFO post at one company to another, but eventually many decide to apply their skills in a different setting. A growing number of finance managers, like Mingrone, have their sights on other positions from an early stage, with experience in finance serving as the route to get them there. Some companies treat the top finance post as one of many stops on the development path for high-potential executives, rotating them through the CFO office regardless of whether they have prior experience in the finance department.

Some fear that this raises the risk that the company’s chief steward, blinded by ambition, will ignore the key fiduciary duties of the CFO role. Even worse, short tenures and skewed incentives may encourage the executive charged with maintaining internal controls and managing risks to cut corners in order to boost short-term performance (and thus their own career prospects). These worries are largely unfounded, for two reasons.

First, the CFO’s stature and influence arise from the post’s privileged access to information across a firm, making the finance chief a trusted adviser to boardroom colleagues and a crucial conduit providing information about company performance to external stakeholders. As the volume of data companies can collect to gauge this performance expands exponentially, it is the CFO who is charged with interpreting it, imbuing the role with an air of omniscience. In this data-driven context, missteps are punished severely and fall disproportionately on the CFO, who is assumed to have all the answers. If anything goes wrong on their watch, a CFO’s ambitions will be swiftly curtailed. Live by the numbers, die by the numbers.

Second, as more CFOs move into positions beyond finance, finance chiefs gain an ever-expanding group of allies. At many companies, the chances are that the CEO, directors and business-unit heads will all have spent time in the finance function at some point during their careers, if not in the CFO post itself. Their understanding of the tensions inherent in the role makes them aware of the challenges that CFOs face, as they themselves may have struggled to strike the balance between steward and strategist at one time. This makes them less likely to pressure CFOs to betray their principles or compromise their independence.

The image of the CFO as an isolated accountant toiling quietly in an insular function is obsolete. In a sense, the corporate world is now filled with CFOs, and not only in the finance department.

This is adapted from the book, “The Chief Financial Officer: What CFOs do, the influence they have, and why it matters,” published by The Economist and Profile Books and available now in the UK. It will be published in the US by PublicAffairs in April 2014.