One of the byproducts of Americans’ ongoing love affair with the automobile is the enduring strength of their relationship with radio—especially the old-fashioned terrestrial (AM/FM) kind.

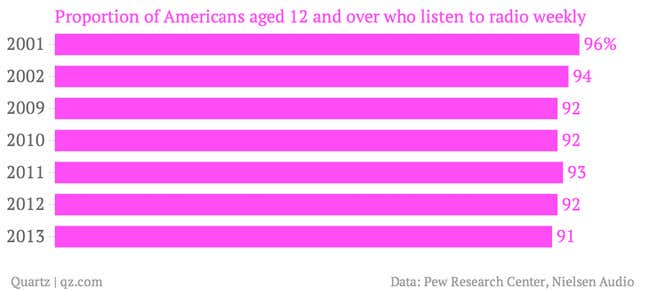

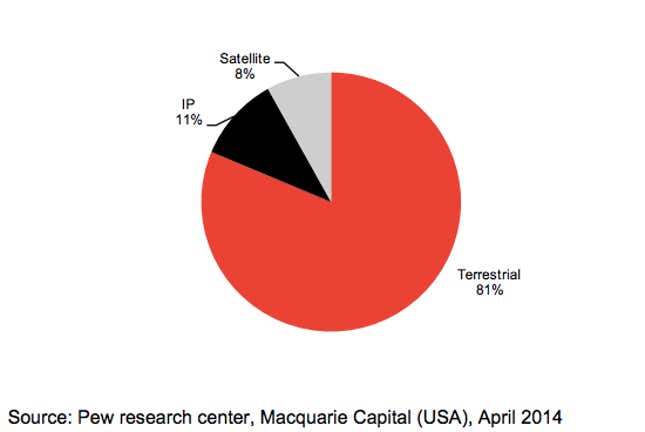

While the number of Americans that listen to some AM/FM radio has shrunk marginally over the past decade, it has also remained firmly above the 90% threshold—an astonishing level of penetration when you consider the number of alternatives (MP3s, streaming music services, satellite radio) that have emerged over that period. And old fashioned radio continues to trounce the most comparable of those—satellite radio and internet radio—in terms of its share of listening hours.

Business wise, it’s a similar story. According to analysis by Macquarie Capital, terrestrial radio’s share of the advertising market since 2011 has remained fairly stable at about 10%, in contrast to the sharp falls experienced by other legacy media segments like newspapers and magazines.

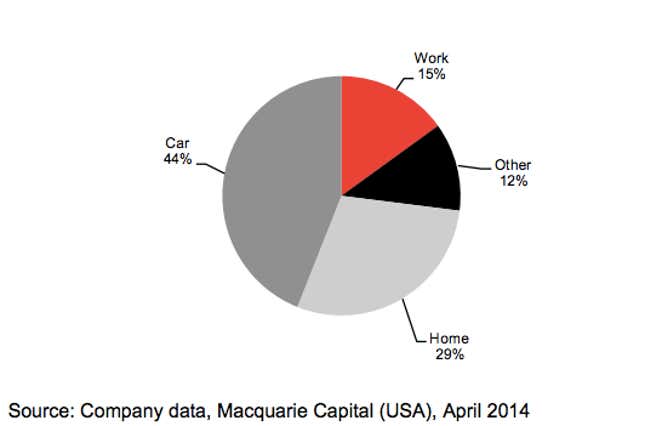

It’s arguably best explained by the fact that most listening takes place in the car, where old fashioned AM/FM radio still reigns supreme. 44% of all radio listening takes place in the car, where terrestrial radio has an 80% share, according to Macquarie.

Yet while old-fashioned radio has proved remarkably resilient up until now, it could be approaching an inflection point thanks to the advent of the internet-connected car. GMSA, an industry group representing mobile operators, last year said it expects 50% of all new vehicles (pdf) sold by 2015 to be internet-enabled, and 100% by 2025.

Internet radio services give listeners a near-infinite amount of options, and advertisers the ability to target specific audiences, but they also face disadvantages. Pandora, the biggest internet radio service in terms of listening hours, has signaled a huge push into connected cars in 2014, but it still must pay higher royalties to artists than traditional radio. (Spotify, which many consider Pandora’s true rival, pays even higher royalties).

The top radio companies have established hedges against the internet radio revolution: Clear Channel, the biggest radio company (which through a subsidiary syndicates The Rush Limbaugh Show, among other programs) is the owner of internet service iHeartRadio, and Cumulus Radio has taken a 15% stake in Pandora rival Rdio. That might sustain their link with the American public for years to come.