Dr Dre’s Beats Music is copying Spotify but should be copying Pandora instead

Dr Dre may know a lot about the music industry, but that doesn’t mean he understands the music streaming industry.

Dr Dre may know a lot about the music industry, but that doesn’t mean he understands the music streaming industry.

The rap legend’s headphones brand Beats, which he co-founded with Jimmy Iovine, is set to launch Beats Music in the US early next week, and it’s going to look and work a lot like Spotify. Like the popular music streaming service, Dr Dre’s new offering will feature a near-endless pool of licensed music—more than 20 million songs in all. Like Spotify, Beats Music will also rely on monthly membership fees. Unlike Spotify, Beats will offer no free version, only a free one-month trial. Beats also promises to offer an advanced music curation service that will help create music playlists and suggest songs and artists based on a user’s taste. Spotify does this too, but Beats claims it will do it better.

So what’s to differentiate the two? Not much, save for Dr Dre’s powerful marketing team—his headphones have been a wild success—and its promise of advanced music discovery, which does things like log what it calls a user’s “music DNA.” There’s also a deal with mobile provider AT&T, which will allow Beats to sell its service as part of family mobile plan. But essentially, Beats is betting it can beat Spotify at its own game.

There’s only one kink in Dre Dre’s master plan: He’s shouldn’t have chosen Spotify as the company to copy. Pandora may not be the coolest music streaming product, but it is the best music streaming business right now.

To make people pay, or not to make people pay

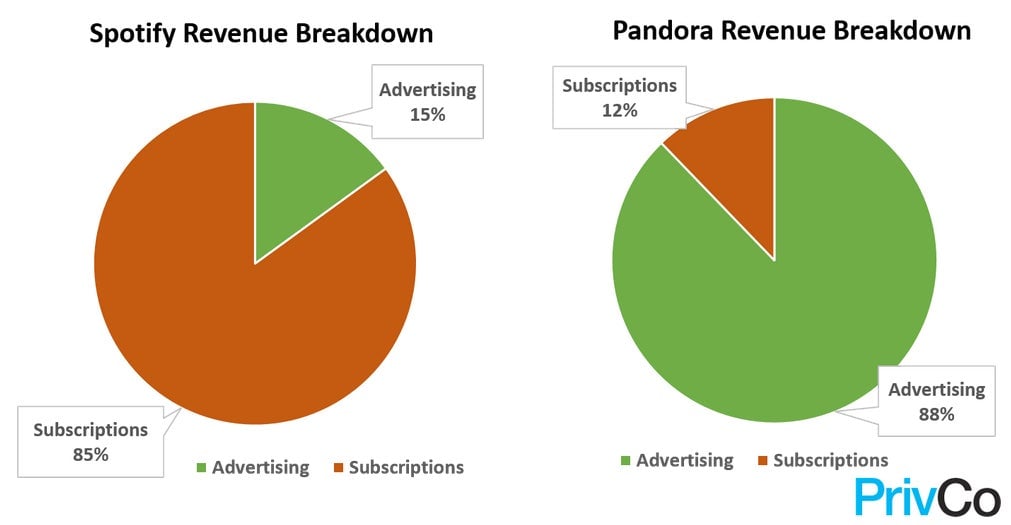

Spotify has done a great job of growing revenue: Its sales jumped more than 100% from 2011 to 2012. The company’s revenue even exceeded Pandora’s in 2012. But Spotify depends heavily on not only growing its number of users, but convincing them to pay the extra $10 per month for its full service. Pandora’s revenue, on the other hand, is almost entirely ad-driven.

The revenue structure at Beats will be even more subscription-heavy than Spotify’s, since there won’t be any free version, only the $9.99 monthly fee.

The freer the bigger

While Spotify’s reliance on subscription fees may not seem like a problem now, it could soon. The market for Spotify’s paid service is a mere fraction of that of Pandora’s, which is essentially the same size as the market for radio. “If you’re asking people to pay for music, the market shrinks drastically,” James Marsh, a music business analyst at Piper Jaffray, told Quartz. “The vast majority of US music listeners won’t pay for music.” Look no further than Pandora’s more than 200 million users for evidence. Spotify has around 26 million worldwide.

One might just argue that Spotify and Pandora are gunning for two different pieces of the market. Spotify lures dedicated music fans who know what they want to listen to, and are willing to pay to avoid ads; Pandora caters to the massive pool of people who want music, but aren’t terribly particular about what song is played and when. But Spotify seems to already be leaving its corner, at least partly, to see what Pandora’s has to offer.

The ad advantage

While both companies have yet to turn a profit—Spotify and Pandora’s net margins were negative 14% and 9%, respectively, in 2012—Pandora is at least seen as having the potential to flip that on its head down the road. And it has a lot to do with how it sells its ads. Rather than focusing on large, national advertisers, the company is instead deploying local sales teams to rake up smaller, more localized businesses, just like radio stations do. “Pandora’s investment in local sales forces and localized advertising is going to be key,” Marsh said. It’s going to allow Pandora to increasingly sell geo-targeted ads, which it can sell for more, and to far more clients.

Spotify’s subscription-based model, however, will continue to depend on its ability to not only woo users, but woo them to pay. At the moment, fewer than a quarter of Spotify’s nearly 26 million users are paying members. Spotify recently announced that it would no longer limit the amount of free music listening it offers its customers, in hopes of upping its ad-based revenues.

Beats is waving around its partnership with AT&T as something that will help it attract more customers. The trouble is, a lot of ones who are willing to pay for music are probably already doing so on Spotify. “I can’t really tell why existing Spotify users would want to switch since, on the surface, Beats Music has basically the same set of features for the same price,” as Matthew C. Klein wrote for Bloomberg.

And then there’s the matter of costs

Despite Spotify’s strong revenue growth, its costs grew by about the same amount. Licensing music, as Spotify does, and Beats Music will, is expensive. Pandora licenses music too, but not in the same way, or for nearly as much money, because it costs a lot more to license music that users rewind, fast-forward, and play on repeat—as Spotify does—than it does to license music that listeners have little control over. “The more like radio it is, the easier it is to access that content. Once a user starts skipping songs, or playing songs repeatedly, it becomes more like ownership, and costs more like ownership,” Marsh said. Music-streaming companies need 5-10 million paying users to turn a profit after licensing fees, according to Recon Analytics. Six years since Spotify first launched, it is still well below 10 million.

When Beats Music launches next week, it will likely mark the beginning of a long battle to control the subscription model streaming business. But even if Dr Dre ends up winning that war, he’ll likely only end up realizing he chose the wrong subset of the music streaming world to take on. Using his industry clout to sell a free product to rival Pandora would have been wiser.

Beats Music didn’t reply to a request for comment.