Boring is the new exciting.

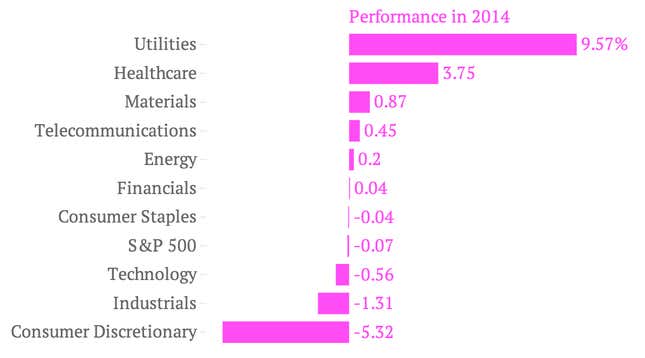

Like everyone else on earth, we’ve noted the pounding that high-flying tech stocks have taken in recent days. While sexy stocks such as Tesla, Netflix, Twitter and Facebook have captured people’s imagination over the last year, the truth is that, this year, investors have been far more interested in solid, dividend-paying blue chips. That’s the dynamic that has made utilities—yes, utilities!—the best-performing part of the US market so far this year.

Barron’s made a good case for buying utilities not too long ago. And honestly, the case is pretty much always the same. Stocks in the sector pay a great dividend. (At last glance it was about 3.8%, versus a bit less than 2% for the S&P 500.)

But it’s received wisdom that shares of gas and electric companies also tend to be a good place to take shelter when the markets get a bit rocky. So one way to interpret the rise of the utilities sector this year is that investors are bracing for an ugly selloff in the broader market.