We’ve predicted that oil and gasoline prices are going to go much lower in the long term, as the American shale oil reserves now starting to be tapped begin pumping out their bounty. Bernstein Research’s Bob Brackett disagrees. In a note to clients on Oct. 26 he argues that the shale will produce a lot, but that prices are not going to fall much, if at all, from their current level. He titled his note, “For Halloween, a Chart that Could Scare the Oil Bulls.” (Reproduced with Brackett’s permission above.)

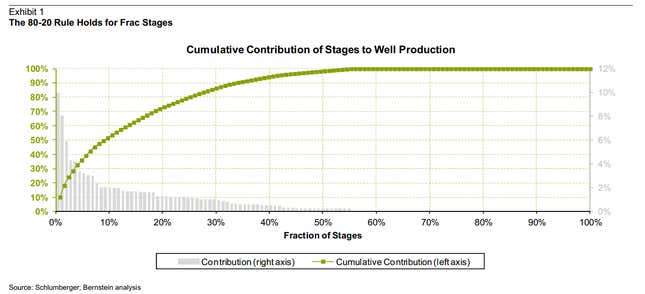

Brackett is referring not to oil price bulls, who think prices will stay high, but production bulls—those who think the world is headed into an age of oil surplus. He asserts that the production profile of shale oil is so idiosyncratic that wells produce 80% of their lifetime output in their first 20% of their lifetimes, and stop producing any oil about half of the way through—in other words, that their operators keep running them long after there’s any useful output.

Hence, in three years or so the US will produce about 10.5 million barrels a day, surpassing the current production of Saudi Arabia and Russia. But that volume, says Brackett, won’t be large enough to tip global markets. Brent benchmark oil will be about $110 a barrel, and starting around 2015 it will go higher. It will not drop into the $80s-a-barrel level, as others have forecast. “We are no Cassandra prophesying the collapse of production, but in a world of Polyannas have apparently been awarded the role,” quips Brackett.

In Brackett’s view, there is good news between the lines—shale oil is not going to revolutionize global energy, as some think, he says. But if oil drillers are smart, they will cut out the last, fruitless stages of current drilling and save much on their expenses. And that should make those who listen to him much, much richer.