Another day, another selloff in the Asian markets. China’s Shanghai Composite was down more than 1%. (Though Hong Kong’s Hang Seng was roughly flat.) Other China-linked markets are also taking it on the chin. Australia’s markets fell. Brazil’s Bovespa is down 1.1%.

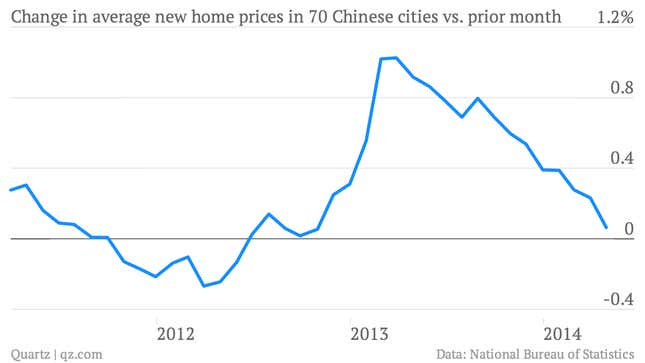

The culprit? Another less-than-hot reading on the Chinese housing market. China’s National Bureau of Statistics’ report on 70 large housing markets showed the price of new homes rising at a scant 0.1% in April, compared to the prior month. And if the current trajectory continues, monthly prices look set to start falling into negative territory quite soon.

While China’s economy has been slowing for a while, the stark slowdown in the housing market seems to be pushing it into a new, risky phase. The key concern seems to be uncertainty about how China’s banking system would handle a housing correction, if not an outright bust.

Few expect a Lehman-style moment of financial crisis in China. (The prevailing wisdom is that the government would never allow it.) But a likelier result might be the zombification of the Chinese economy. That’s the process that set in once Japan’s property bust infected its banking system in the early 1990s, sapping growth for more than a decade. And that’s why investors in China—and in economies closely intertwined with the People’s Republic—are rightfully concerned.