China’s housing bubble is collapsing, and here’s what it looks like

It’s really happening. China’s hyper-hot housing market is turning south. Fresh charts cooked up by economic analysts at Barclays show the trend pretty clearly.

It’s really happening. China’s hyper-hot housing market is turning south. Fresh charts cooked up by economic analysts at Barclays show the trend pretty clearly.

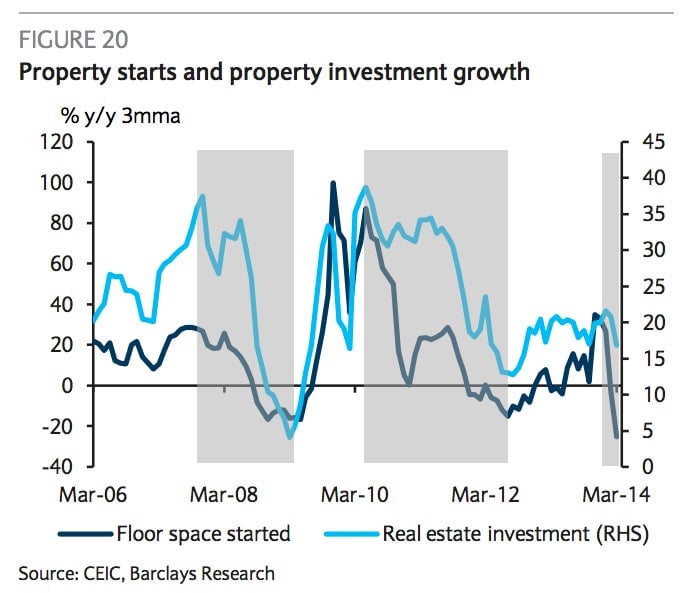

Housing starts have tanked

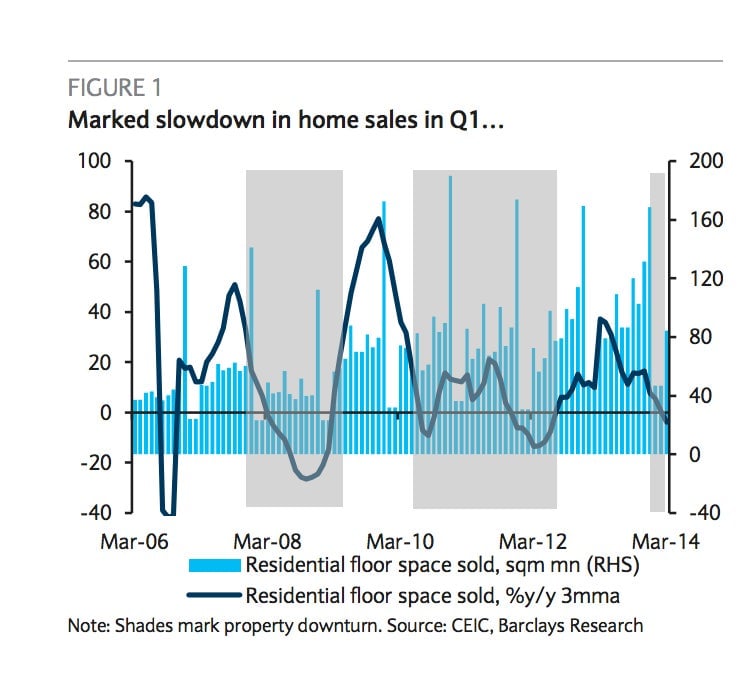

Sales are falling

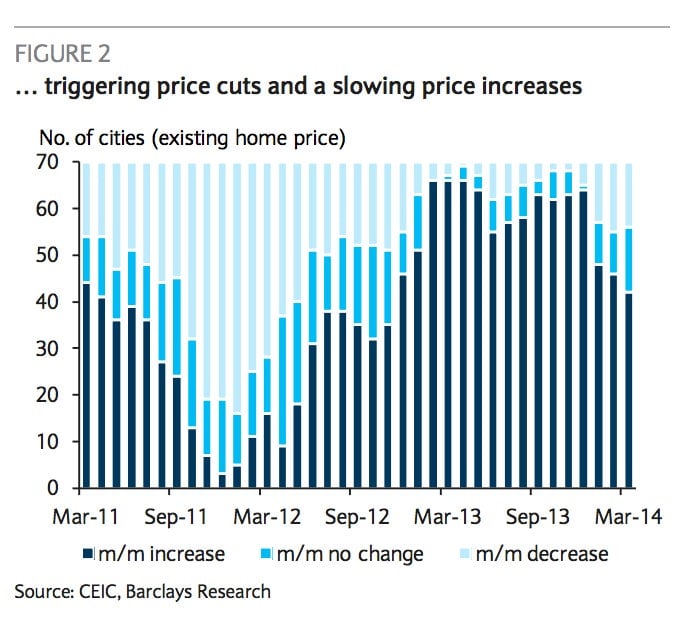

Prices are dropping

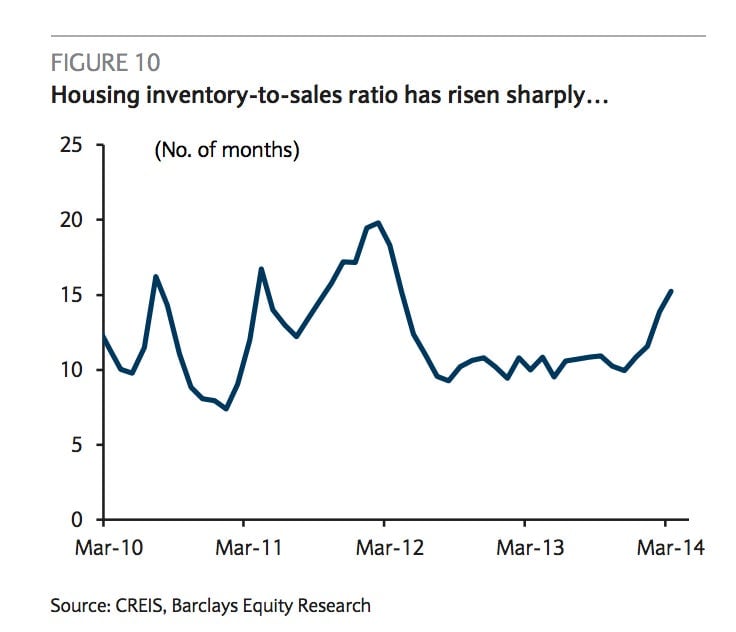

And levels of inventory are rising

So what?

Well, for China, there’s a lot to worry about. China’s middle-class consumers have huge chunks of their personal wealth wrapped up in the housing market. So, a disastrous bust would severely impact consumer confidence and undermine China’s effort to rebalance its economy toward domestic demand.

A housing bust would also have deleterious effects on the Chinese financial system, raising the risk of either a Lehman-like crisis or a Japan-style zombification of the economy (perhaps both). Either would be a big blow to Chinese growth, which already seems to be slowing fast. The OECD just cut its growth forecast for China, citing concerns about the financial system, and president Xi Jinping told his compatriots a couple of days ago to get ready for a “new normal” of slower growth. And as these charts suggest, those concerns are quite well placed.