The worst-kept secret in global business is that Sprint is about to buy T-Mobile US in a deal people expect to be worth around $50 billion. Yet there are widespread concerns that a deal between the third- and fourth-placed carriers could reduce competition in America’s wireless market.

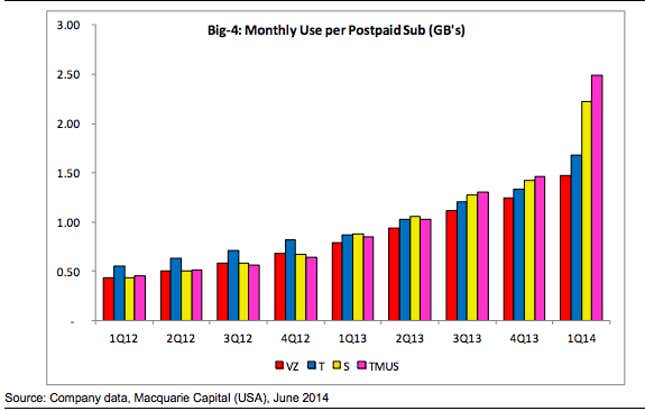

Over the past year or so, T-Mobile US, which is spearheaded by the unorthodox CEO John Legere, and Sprint with its “framily” packages, have been competing aggressively to win market share away from the big two carriers, Verizon and AT&T. Their competitive plans have led to soaring data usage by customers of both companies, as the above chart from Macquarie Capital shows.

Sprint and T-Mobile are expected to argue that by uniting they will be able to provide sterner and more sustainable competition for Verizon and AT&T. They will likely have to make concessions—and Sprint may have to lower prices to match T-Mobile’s. Masayoshi Son, the ambitious chief of Softbank, which owns most of Sprint, has already pledged a “massive price war.”

For the record, Macquarie predicts that the deal, if and when it is formally announced, will likely be allowed: Its analysts say that there is a 70% chance of approval by regulators.