HALIFAX, Canada—Over the last half-dozen years, a swarm of companies from around the world including General Motors has snapped up licenses for a lithium-ion electrode that promised to deliver the next big step in making electric cars competitive with conventional vehicles. The companies and outside researchers have worked feverishly to optimize the electrode, including an assault on a flaw that gravely undermined its performance.

But in recent weeks, researchers working on the problem have gone public with a conclusion that the electrode, invented contemporaneously here at Dalhousie University and at Argonne National Laboratory outside Chicago, won’t realize the hopes to bring alive a mass-market electric-car age. They say the problem is at the heart of the physics of the electrode, an amalgam of nickel, cobalt and manganese (NMC) that achieves remarkable capacity after a jolt of unusually high voltage, and does not seem fixable.

If true, the little-noticed concession is a serious setback for GM and a large swath of the automobile industry. It would also represent a victory for actors from ExxonMobil to Tesla Motors that have placed bets against the ability of scientists to create a breakthrough automobile battery. Exxon and other oil super-majors say electric cars will grab only a slender market niche for at least another quarter century and probably longer, and Tesla’s Elon Musk is gambling that he can keep using off-the-shelf batteries to power his otherwise technologically dazzling vehicles.

Jeff Dahn, a Dalhousie professor and a pioneer of the troubled electrode, says the skeptics are writing off the invention rashly. Standing in his second-floor laboratory, Dahn said his team is reconfiguring the electrode in a way that will extract its best attributes while avoiding its traps. Hurdles remain, he told Quartz, but “I don’t think it’s as big an issue as people are making it.”

The story begins 14 years ago

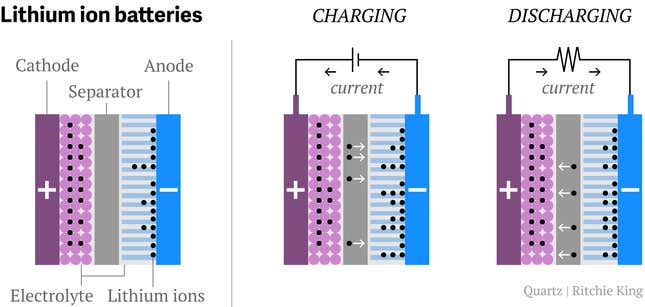

A lithium-ion battery contains two electrodes—one positive and one negative. The positive, called a cathode, is the single most expensive component of the battery. Hence researchers have spent much time attempting to identify cheaper materials that also deliver greater distance.

The batteries in your smartphone are probably based on cobalt oxide, which are terrific for electronics but too expensive and volatile for vehicles. Musk relies on an amalgam of cobalt, nickel, and aluminum (NCA), which he argues is relatively cheap and—most important—already under mass production by Panasonic. But others think NCA is too volatile also, and it has not been widely embraced.

The twin goals of economy and distance appeared to be met in the Dahn-Argonne cathode. Dahn, working on contract with 3M, and a team at Argonne filed competing patent applications for the NMC cathode in 2000. The central feature to both was an unusual concentration of relatively cheap manganese and powerful lithium. The rival patents sat around unnoticed until six or so years ago, when the US, China, and other governments and commercial players around the world suddenly embraced a future of increased electrified personal transportation.

Dahn’s and Argonne’s NMC formulations were snapped up in licensing deals by big global companies including GM, South Korea’s LG Chemical, Germany’s BASF, Belgium’s Umicore, and Japan’s Sony and Matsushita. GM installed Argonne’s version in the Chevy Volt, a plug-in hybrid that included both a battery and a small gasoline-propelled engine. It could travel a little under 40 miles before its gasoline engine kicked in, a distance that GM claims covers the daily driving habits of most Americans.

So the licensees have eagerly awaited the second-generation cathode

But this was the first-generation cathode and the Volt—like all other electrified vehicles—remained a niche buy. GM and the cathode’s other licensees awaited the second-generation cathode, which promised to approximately double lithium-ion’s typical capacity, to about 280 milliampere-hours per gram, sufficient to knock down the price and take an electric car much further before requiring a charge. GM, for one, counted on twinning the second-generation Argonne cathode with a breakthrough anode made of silicon—the anode is the negative electrode contained in every lithium-ion battery—and to manufacture a mass-market-priced, 200-mile electric car by 2018.

But that is not what has happened. Instead, the ambitions for the cathode foundered on its physics.

The key to the second-generation cathode is an unusual jolt of voltage that unlocks the higher performance. The best current lithium-ion batteries operate at an average of 3.7 volts or so. The idea with the NMC formulation was to operate it at 4.7 volts. The resulting leap in energy is what got the licensees so excited.

But researchers began to notice a problem with the cathode at the higher voltage, which was an unexplained fast and steep loss of energy as the battery went through charge-and-discharge cycles. They called the malady “voltage fade.” Until it was fixed, they said, the second-generation material could not be used commercially.

With so much at stake, the US Department of Energy directed Argonne to mount an extraordinary effort to figure out and solve voltage fade.

At first, GM seemed to capture the inside track through a licensing deal with a Silicon Valley startup called Envia Systems, which appeared to have made impressive progress with voltage fade. But then the deal collapsed amid accusations of hyped promises—voltage fade was not fixed, and GM’s near-term ambitions for a 200-mile electric car unraveled. (GM declined to comment.)

Then, last month at an annual conference organized by the US Department of Energy, Argonne team members stood one after the other and explained that voltage fade could not be fixed. They said the cathode’s constituent elements—the manganese, the nickel, the oxygen, the cobalt and the lithium—appeared to scramble with the application of 4.7 volts of electricity. After a very few charge-discharge cycles, the cathode morphed into a material with different, suboptimal properties as far as its utility for an electric car.

“Fade appears to be a fundamental property of this material,” Tony Burrell, director of the battery department at Argonne, told the conference. “It is like being surprised that wood combusts with oxygen.” Burrell was saying that there was simply no way to avoid voltage fade, a natural feature of the second-generation cathode at high voltage, it unfortunately turned out.

But will NMC have a new day?

Dahn suggests that the Department of Energy and Argonne are making too big a deal of the issue. The problem is real, he says, but “there has been a sort of mental explosion that this is a disaster. Even with voltage fade, it doesn’t mean the material is useless. You just have to deal with it.”

His approach is to modify how the material is used. Until now, the cathodes have been a uniform construction of the NMC formulation. Dahn has found better results using the formulation only as a thin and potent shell around a differently comprised inner electrode. This approach does not trigger voltage fade even at 4.7 volts, he said.

He still has other problems to solve, including with the electrolyte, the substance that stands between the two electrodes and facilitates the movement of lithium. But he has hopes. If he has success, he said, “it would be designed to be used in electric cars.”

Despite the resignation on display at the Department of Energy conference last month, Argonne, too, is working on new approaches. A team led by Khalil Amine, for instance, carefully modulates the metals—the researchers gradually lower the proportion of nickel in the cathode, while they increase the manganese. The result is greater stability.

Even if Dahn and Amine are successful with their competing solutions, the resulting cathodes would fall short of the original hopes. Theirs would be a smaller step along the way to enabling price-competitive electric cars. But Argonne’s Burrell says the NMC material cannot be abandoned because it remains “in a class of its own.” It is still has the best potential as far as electric cars are concerned. He asserts that, even at 4.2 volts—below the activation point required for the second generation cathode—Argonne’s NMC formulation is significantly cheaper, for instance, than Elon Musk’s NCA batteries. NCA costs $60 per kilowatt hour compared with $45 for Argonne’s NMC, he said.

At the Energy Department conference, Chris Johnson, a co-inventor of the Argonne material, beseeched the audience of researchers, “Let’s not give up at this point.”

After publication, Quartz received the following statements from Kevin M. Kelly, a GM spokesman:

“First off, I want to clarify that none of the materials currently used in the battery cells on our current vehicles have the issue you describe. The material I think you are referring to is being studied for potential future use.

“We’re pleased that people are working on improving the performance and reliability of these type of materials. GM is actively developing multiple chemistries to support our future portfolio so as not to rely on the success of a single solution. We do not discuss specifics when it comes to future technologies we may bring to commercialization.”