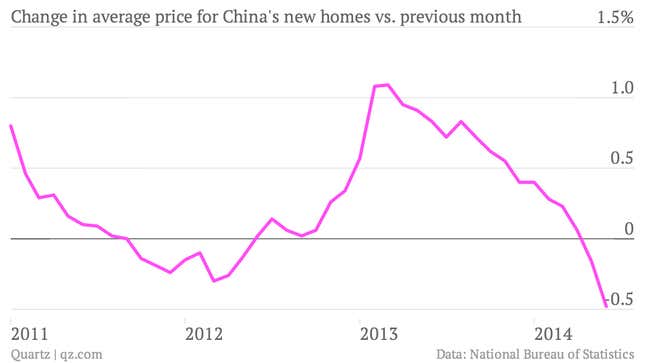

To go by China’s 7.5% GDP growth in the second quarter, the country’s economy seems to be on the mend. But the most recent housing market data would suggest that recovery is still a ways off—and that things may still get a lot worse yet. Here’s a look at the trend in home-sale prices versus the previous month:

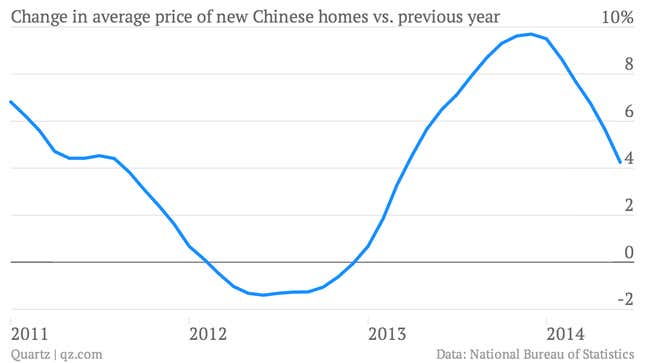

In 55 out of 70 of the major cities whose home sales the National Bureau of Statistics tracks, June prices came in lower than May’s—a huge leap considering that only half of the cities tracked reported falling prices in May. According to Wei Yao, economist at Société Générale, the decline of the 70-city average was the sharpest drop since Dec 2008. The year-over-year prices are still going up, but their rate of increase is slowing sharply too:

Of course, it’s no surprise that China’s housing market was in a shabby state in June; things have been looking grim for the last half-year. But what’s worrisome, says Yao, is that the sales volume contracted sharply despite large price cuts that developers had been offering throughout June. (The uptick in incidence of state-run newspapers urging people to buy homes suggests that things haven’t improved much in July. )

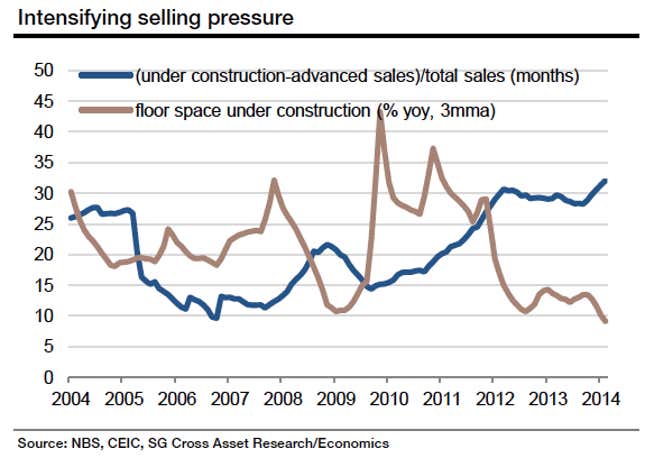

This is driving housing inventory to new highs. In the chart below from SocGen, the blue line reflects inventory in 35 major cities, while the tan line tracks the amount of floorspace under construction. As you can see, even as construction has slowed, inventory continues to soar:

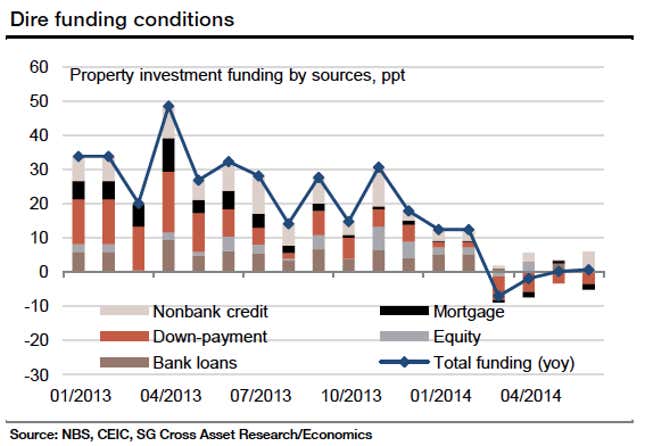

The immediate concern, at least for China’s GDP-obsessed leaders, is economic growth, between 16% and 20% of which comes from real-estate investment. And that picture isn’t very pretty. Developers are struggling to get cash, notes Yao. And not just developers; despite the central bank’s command that banks loosen mortgage criteria, mortgages fell 2.6% compared with June 2013.

If growth in real-estate investment continues on its swift descent, SocGen estimates that it could drag down China’s annual real GDP growth by three-quarters of a percentage-point. That’s bad news for a country that hit the spending pedal just to push Q1’s 7.4% GDP growth rate to 7.5% this last quarter.

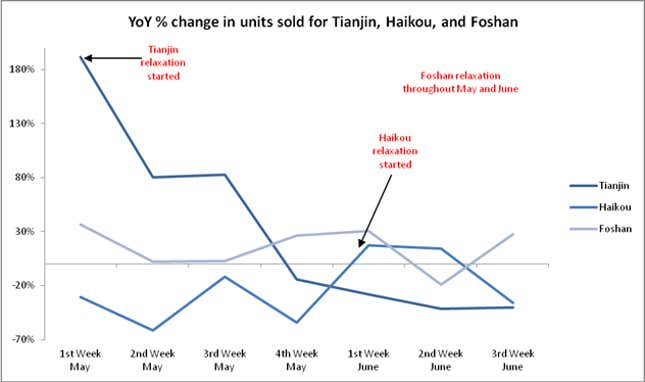

This bleak outlook is probably why the central government has allowed slew of local governments to relax home-purchasing restrictions of late. Given the latest data many more will likely follow suit. But while the market sees such loosening as a way for the government to goose demand, it rarely works like that in practice, says JL Warren Capital’s Junheng Li. Here’s a look at how buyers have responded to recent loosening of home-purchase restriction in three cities:

The root cause of the housing bubble is China’s underdeveloped financial market, where investment options are limited,” says Li. “During a downturn, homebuyers lose faith in the continued rise of house prices. When confidence collapses, there is nothing the government can do to boost fundamental demand for expensive properties.”

That likely means another infrastructure investment bender; SocGen’s Yao estimates that in order to offset the continuing fall in property investment, the government will need to up infrastructure spending by more than 30% versus 2013. While that mega-stimulus will invite a host of problems for China’s fiscal health, it’s probably preferable to the sort of broad-based credit loosening that would juice growth—and likely inflate the property bubble once again.