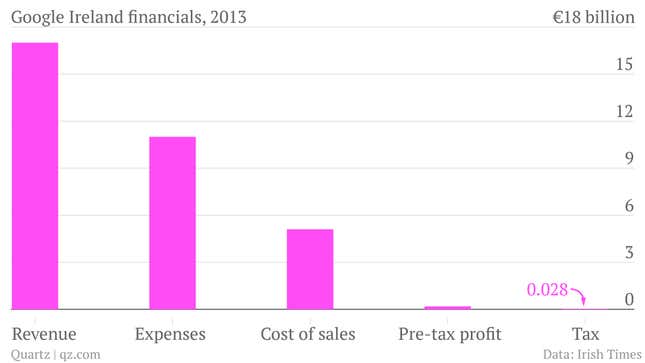

First the good news: Google is paying more tax in Ireland, up an impressive 63% to €27.7 million ($37.25 million) in 2013. Here’s the even better news (for Google, that is): that’s just 0.16% of the €17 billion in revenue Google raked in from its various European operations last year. And most of these operations are billed from Ireland.

Of course, it’s not fair to count tax a percentage of revenue, so here’s a slightly better measure: In 2013, net income before tax at Google Inc, the US company, was a little over 20% of revenue (p.27). If its European operations were equally profitable, that would suggest net income of €3.4 billion, making Google Ireland’s effective tax rate 0.81%—still hardly a big burden.

How does Google do it? Well, it costs money to make money, so over €5 billion went to towards the cost of sales. And then there are those pesky “administrative expenses,” which amount to a whopping €11.7 billion, according to the Irish Times. (Google filed its documents yesterday but the Irish authorities have not yet made them available online.) That left Google Ireland with less than €200 million in pre-tax profit, which makes the €27.7 million in tax look pretty respectable.

Why, though, would any company persevere, running a huge, continent-straddling business when the returns are so slim? The answer is that they aren’t. The profit goes to a second Google entity registered in Ireland: Google Ireland Holdings, whose directors are, according to Bloomberg, “two attorneys and a manager at Conyers Dill & Pearman, a Hamilton, Bermuda law firm.” Here’s how it works, as Quartz explained last year:

Google Ireland sends the money to Google Netherlands Holdings, which also receives cash from Google Singapore. The Netherlands has no “withholding tax,” which is a compulsory pre-payment of tax similar to the bit lopped off your paycheck. That’s the “Dutch sandwich.” Google Netherlands sends all the booty to Google Ireland Holdings—a second company registered in Ireland but tax resident in Bermuda. Whence the “double Irish.”

The numbers for other European countries are even lower. Google also filed its UK numbers yesterday, where it paid £20.4 million ($34.6 million) in tax on revenues of $5.6 billion (paywall). The company has faced plenty of criticism (paywall) for its tax structures.

Yet it is hardly the only one that does this. Apple uses a similar tax structure, as do several other firms with their European headquarters in Ireland. But there are signs European countries are not going to stand for it very much longer. France is in the midst of investigating Google for tax non-compliance and has been pushing for a Europe-wide “Google tax.” And Ireland itself is considering tax reforms to righten its rules. But don’t hold your breath for the cash to start flowing into state coffers.