In his day, John D. Rockefeller indignantly denied he sought to brutally “sweat” and crush his rivals. Yet, through his company Standard Oil, most of his rivals were indeed driven out of business and he ended up controlling 90% of the American petroleum market a century and a half ago.

In the latest version of a Rockefeller-style “good sweating,” Saudi Arabian oil minister Ali al-Naimi (pictured above) denied yesterday that his country is in a price war with competitors. But as the price of benchmark Brent plunges through the third symbolic threshold in as many months—now holding below $80 a barrel—one is drawn back to the memory of Rockefeller.

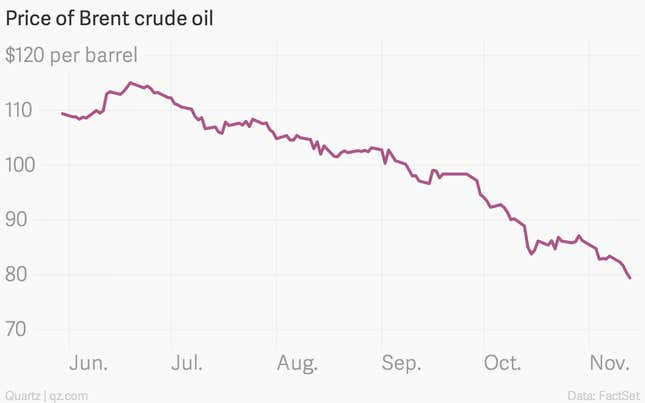

It is true that aggressive pricing does not occur in a vacuum—a glut, a push for market share, or soft demand can contribute to such decisions. But citing a rationale does not change the definition of the resulting action. A price war is on, hastening the drop in oil prices below $100 a barrel in September, $90 in October, and $80 today:

For the record, here is Naimi speaking at a conference in Acapulco:

Talk of a price war is a sign of misunderstanding—deliberate or otherwise—and has no basis in reality. Saudi Aramco prices oil according to sound marketing procedures—no more, no less. These take into account a host of scientific and practical factors, including the state of the market.

Yet, while a determination to continue to dominate the market may be the primary impulse, the Saudis are also keen political and economic actors—they understand the dimensions to their control of the greatest daily oil production on the planet. Which brings us back to sweating.

The rules of sweating

As anyone who exercises knows, one aspect of sweating is that it does not commence immediately—the activity causing the moistness, such as jogging or jumping rope, must go on for awhile. So it is with Rockefeller-style financial sweating—prices must be pushed down over a sustained period before the target of the sweating begins to actually perspire. Experts familiar with the Saudi strategy say that Riyadh is prepared for aggressive pricing for two to five years.

So, if in fact Saudi is sweating someone, just who is the target? In no particular order, it is Iran, Russia, and US shale oil drillers. Again, for the record, Naimi denies any such intentions. “We do not seek to politicize oil,” he said. “For us, it’s a question of supply and demand, it’s purely business.”

But the Saudis, a Sunni-majority nation traditionally at odds with the Shia-majority Iranians, are incensed by the idea that Tehran may obtain a nuclear weapon. Hence, with the Nov. 24 deadline fast approaching for consummation of a nuclear deal between Iran and Western-led negotiators, the Saudis are turning up the economic heat on Tehran. If you are on the Western-led side listening to the most recent public remarks from the Iranian side, you may think that Tehran needs to stew for quite a bit longer before the real sweating starts. But we just don’t know—sometimes sweating goes on in private.

Russia supports yet another Saudi antagonist—Syrian leader Bashir al-Assad. So the Saudis would like Moscow to sweat too.

Finally, the main market reason for Saudi taking these actions is the surge in US shale oil production. With lower prices, the Saudis are testing the will of upstart shale drillers to stick out a period of narrow profit or even losses. In a recent report, the US Energy Information Administration said low prices will result in a halt to some US drilling but that most of it will go on, resulting in a continuing production surge. That means that the US industry won’t see relief from the sweating for some time.