Oil prices are plunging through symbolic barriers at a rate of once a month

As the next OPEC meeting fast approaches, the data increasingly point to relatively low oil prices for some time. Short of the cartel digging deep and finding gumption by Nov. 27, no member will soon make the cuts in oil output necessary to turn around the trend.

As the next OPEC meeting fast approaches, the data increasingly point to relatively low oil prices for some time. Short of the cartel digging deep and finding gumption by Nov. 27, no member will soon make the cuts in oil output necessary to turn around the trend.

In trading today, Brent futures—the internationally traded benchmark—appear to be closing in on $80 a barrel, a symbolic but important barrier. As of this writing, the price had traded at as low today as $80.46. If it falls through $80 some time soon, Brent will be establishing a trend of plunging through a new barrier approximately every month—the price broke through $100 a barrel on Sept. 8, and $90 on Oct. 9.

A main driver for the plummet is American oil exports. Despite a legal ban, petroleum is leaving the US almost as fast as it can—in August, the US exported more than 4.5 million barrels of oil a day, according to the US Energy Information Administration, just below Russia’s 4.6 million barrels a day. (Saudi Arabia, the No. 1 exporter, ships about 6.6 million barrels.)

The nuance is that the American exports generally do not leave the country as crude oil but as refined products such as diesel and gasoline—just 390,000 barrels a day was exported in the form of crude oil in August, the last month for which data is available. Observers tend to focus on pure crude exports, but refined product shipments are so large now—not just from the US, but also Saudi Arabia and the United Arab Emirates—that they are contributing to the soft Brent prices.

Another factor underlying lower prices is that supplies are starting to reappear from an enormous bulge of production capacity that has been off the market since the 2011 Arab Spring—specifically from Libya. For three years, some 3.5 million barrels a day of production capacity had been idle, but hundreds of thousands of barrels are now back from Libya. If a nuclear deal with Iran is signed by the Nov. 24 deadline, or even after, an additional 1 million barrels a day could eventually pour back into the market and push prices even lower.

In a Nov. 10 note to clients, Citi’s Ed Morse called this bulge of off-line production “a form of surplus production capacity.” As it comes back on line, it means that “OPEC is now also a part of the supply problem.”

So OPEC has to cut—but it won’t

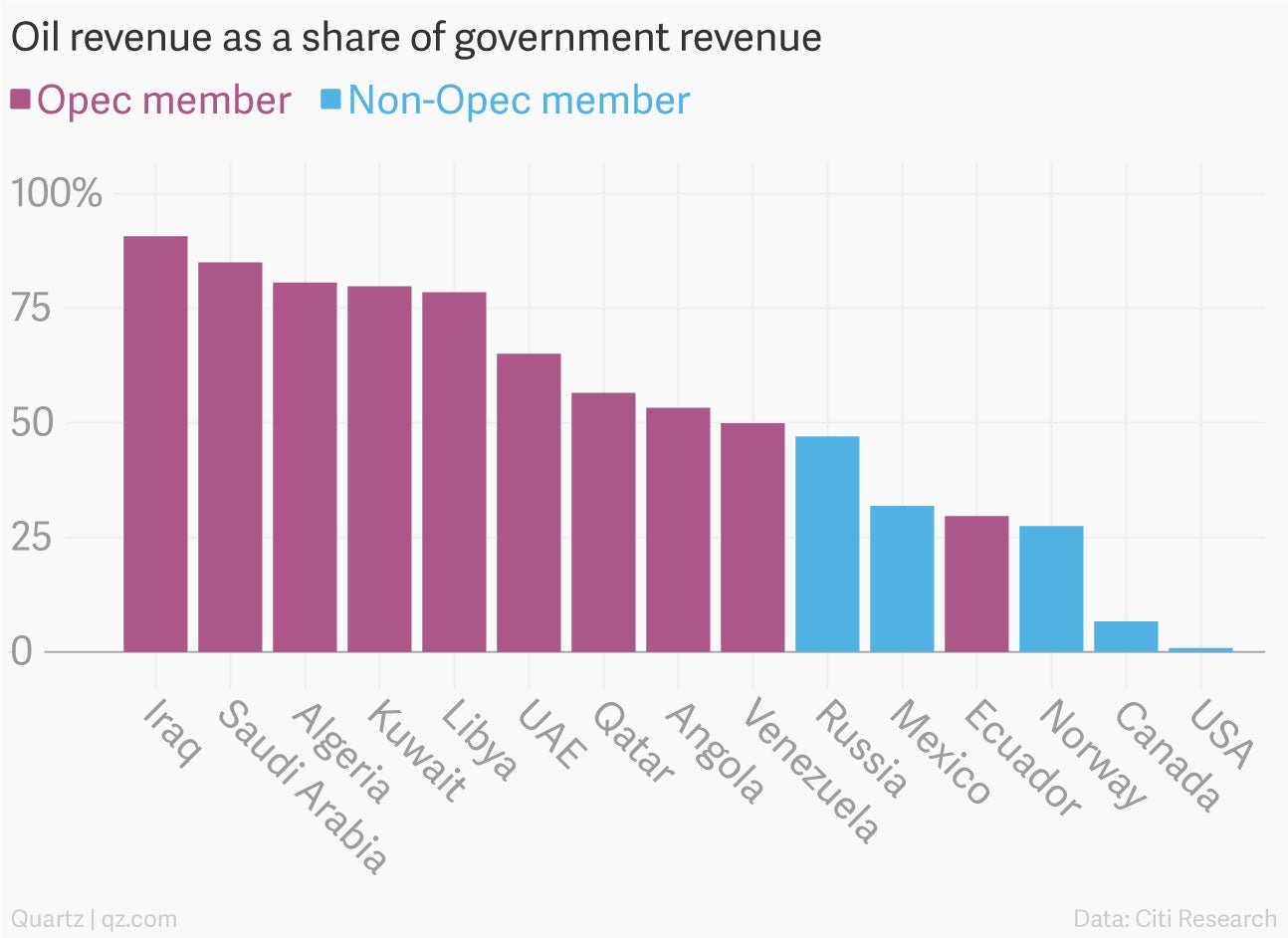

There is very little working against this trend. Hence, unless someone cuts back—meaning OPEC as the biggest single player—the trend will remain down. Yet for most members of the cartel, oil makes up so much of their budget (see chart below) that it is difficult to think seriously of cutting.

Morse said production reductions could come next year, but Phil Flynn of the Price Group said it could take longer. “The message is clear that OPEC is going to pump oil until hell freezes over,” he wrote on his blog today.