For most Brits, financial stability means affording your own home—that’s why two-thirds of households in the country live in a place that they own. But the country’s turbo-charged property market—particularly in and around London—has made buying a home nearly impossible for a big chunk of the population.

That means that more Brits are renting than ever before, and the nonprofit Joseph Rowntree Foundation thinks this might be a problem. In a new report, it reckons that rising private rental prices will push some 6 million vulnerable people into poverty.

The decline of subsidized public housing for rent is partly to blame, the foundation says, as it forecasts that 20% of British households will be private renters by 2040, up from just over 10% in 2000. Meanwhile, renters in subsidized social housing will fall from 20% to 10% over the same period.

People who move from renting to home ownership are much less at risk of chronic poverty, the foundation says. It and most other organizations agree that the UK needs to loosen its planning restrictions and build more in order to boost the affordability of its housing stock for both buyers and renters. But whether these new homes should be public or private, or for rent or for sale, is a matter of intense debate among policymakers.

Whatever the case, what’s clear is that a booming housing market combined with weak wage growth has made getting on the property ladder a distant dream for many Brits, particularly the young. Some fascinating data tucked into the report shows this in sharp relief:

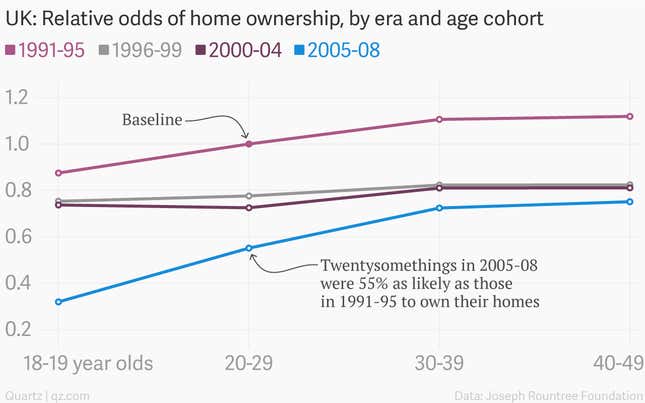

Using panel survey data, the foundation takes twentysomethings in 1991 to 1995 as a baseline and computes the odds of home-ownership among a range of age groups during different periods relative to this group. The data show that twentysomethings in 2005 to 2008 were only around half as likely to have bought a home as the same age group in 1991 to 1995. And recently it’s taking even older Brits longer to buy their first home than it took much younger households in the past.

This is enough for a large share of renters to give up on ever owning a home, as one recent survey has suggested. That doesn’t necessarily mean disaster—people in some very successful and wealthy economies, like Germany, rent their homes in much greater numbers than buy them. It will, however, deprive Brits of a time-honored topic of dinner-party conversation—house prices—leaving only the weather as the thing that everyone can complain about.