There were plenty of dire predictions about the economic impact of the pro-democracy protests that shut down parts of Hong Kong for more than two months, and most of them didn’t come true—tourism actually increased from a year before, and life went on as normal in many parts of the city.

But a handful of businesses were severely impacted by the demonstrations. Here’s who really suffered in Hong Kong:

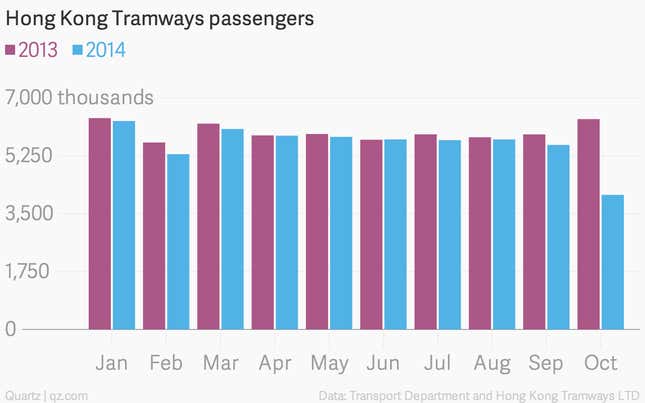

Hong Kong Tramways

The regular routes of Hong Kong’s iconic trams, known as “ding-dings,” carry them right through the main protest site at Admiralty, as well as the smaller Causeway Bay site, so the company was forced to abbreviate its routes. That meant 36% fewer passengers for the month of October, the company told Quartz, for a total loss of 2.3 million riders.

The entire Occupy Central movement cost the company about $1 million, the company estimated at the end of November, and regular service wasn’t fully restored until December 15. The repercussions could be felt as far away as Paris—Hong Kong Tramways is co-ownd by a subsidiary of France’s RAPT Dev, though Hong Kong’s trams supply just a tiny fraction of the company’s overall revenue.

The shops in Pacific Place Mall

This glitzy mall that abuts the now-cleared main protest site counts Harvey Nichols, Montblanc, Burberry and L’Occitane among it tenants. While owner Swire Group is unlikely to have felt much impact from the protests (after all, tenants were still required to pay their rent on time, no matter what was going on outside) some of these luxury brands certainly suffered. An executive from La Perla said that retail sales at the lingerie maker’s Pacific Place store were down 46% for the month of October.

All China Express

The bus company that filed the complaint that actually led to the main protest site being dismantled said ticket sales dropped 17% from Sept. 29 to Oct. 26, costing it HK$691,754 ($89,197), in part because its drop off site was unreachable, as protesters were blocking nearby roads. Presumably that figure more than doubled by the time its routes were cleared.

The damage, collectively, is nowhere near the $5 billion that mainland China’s state-backed newspapers were predicting when the protests first started. But that’s not going to be much comfort for the companies affected.