The biggest markets story of the week was Switzerland. The country’s central bank slashed benchmark interest for the second time in a month and into record-low territory. It also severed the franc’s connection to the the euro. Needless to say, it caught a lot of people unprepared (“Currencies aren’t supposed to move like this. Certainly not currencies like the Swiss franc,” writes Quartz’s Jason Karaian). Foreign exchange brokerages were brought to their knees. Swatch’s CEO was very upset, and relayed his feelings to Bloomberg:

“Words fail me,” Swatch Chief Executive Officer Nick Hayek said by e-mail. “Today’s SNB action is a tsunami; for the export industry and for tourism, and finally for the entire country.”

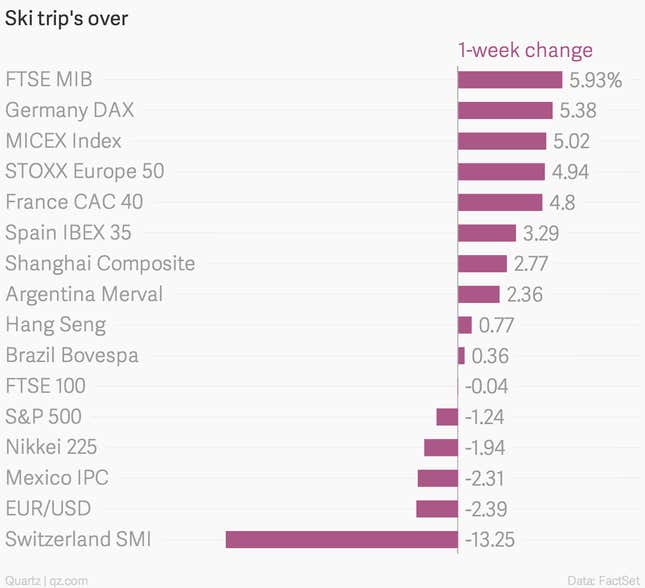

As money flew out of bank accounts and stock positions across the country, Swiss stocks got slammed. But exchanges throughout Europe got a lot of the benefits, with stocks in Italy, Germany, and Russia each up more the 5% for the week.