Tiny Switzerland has thrown a big wrench into global financial markets

Currencies aren’t supposed to move like this. Certainly not currencies like the Swiss franc, long considered a safe, stable store of value.

Currencies aren’t supposed to move like this. Certainly not currencies like the Swiss franc, long considered a safe, stable store of value.

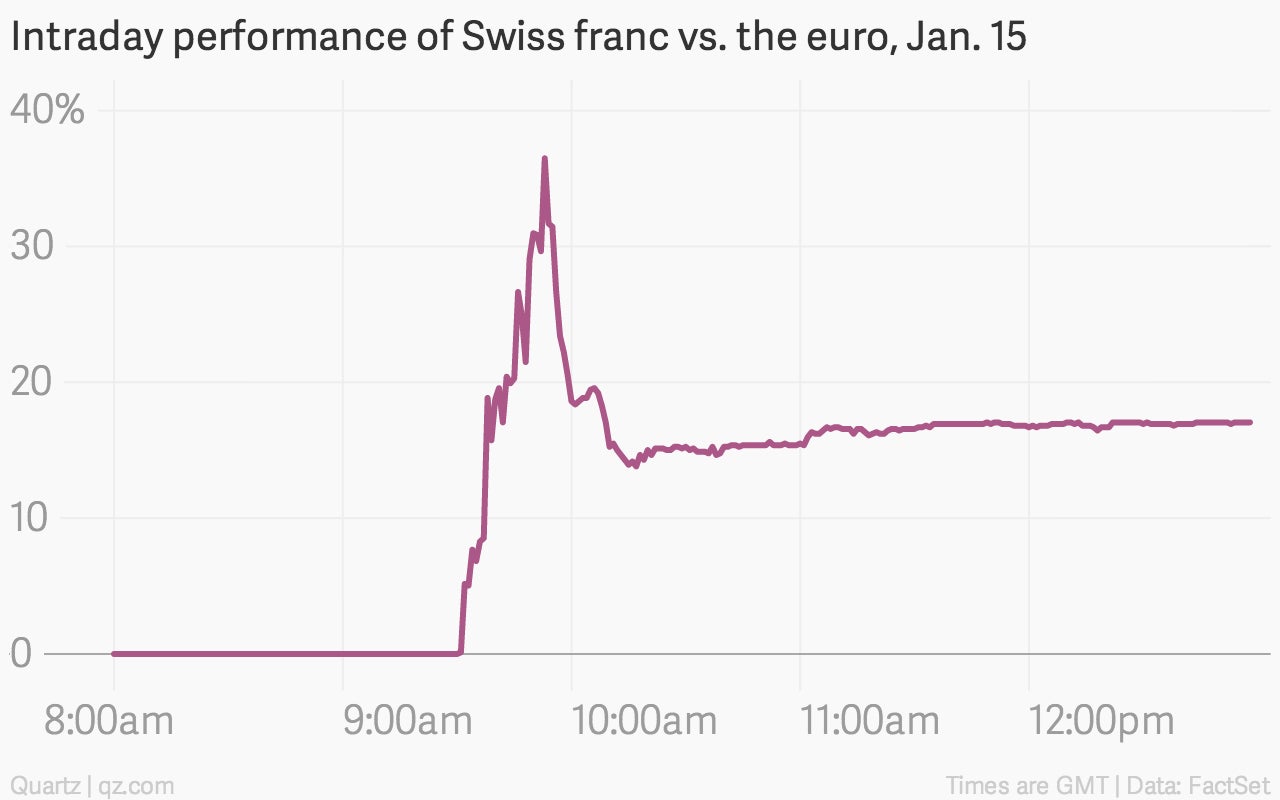

But a shock move from the Swiss National Bank today—we’ll explain in a minute—pushed the franc up, way up, in early trading today. The knock-on effect is roiling a wide range of markets. Get a load of this:

The value of developed-world currencies rarely moves more than 30% in a year, much less in a matter of minutes.

So what happened? Throughout Europe’s financial crisis, investors scrambled to park their money in safe-haven assets, with the Swiss franc a popular port in the storm. This became a problem for Switzerland, as a strong franc hurt the country’s exports. In 2011, the central bank put a cap on the currency, pledging to stop it from appreciating beyond 1.2 francs to the euro. It has traded around that target rate ever since.

Until today. Just this week, the Swiss National Bank’s vice chairman said the franc-euro target ”must remain the cornerstone of our monetary policy.” But then the bank’s chairman, Thomas Jordan, sprang a huge surprise on the markets this morning (pdf)—it scrapped the exchange-rate target, calling it “no longer justified.” Understandably, no analysts saw this coming (paywall).

Without the central bank actively working to hold it down, the franc’s value soared. This is despite the central bank also slashing its benchmark interest rates deep into negative territory, meaning that it will cost money to deposit funds at the central bank, ostensibly a deterrent to holding the franc.

Eye on the euro zone

What gives? Many think this is yet another sign that the European Central Bank is about to launch a full-blown government bond-buying program, which could push the value of the euro (already trading near historic lows) down even further. Essentially, the Swiss are giving up on their expensive experiment in exchange-rate targeting ahead of this potentially significant move. “We need this flexibility,” Jordan said at a press conference today.

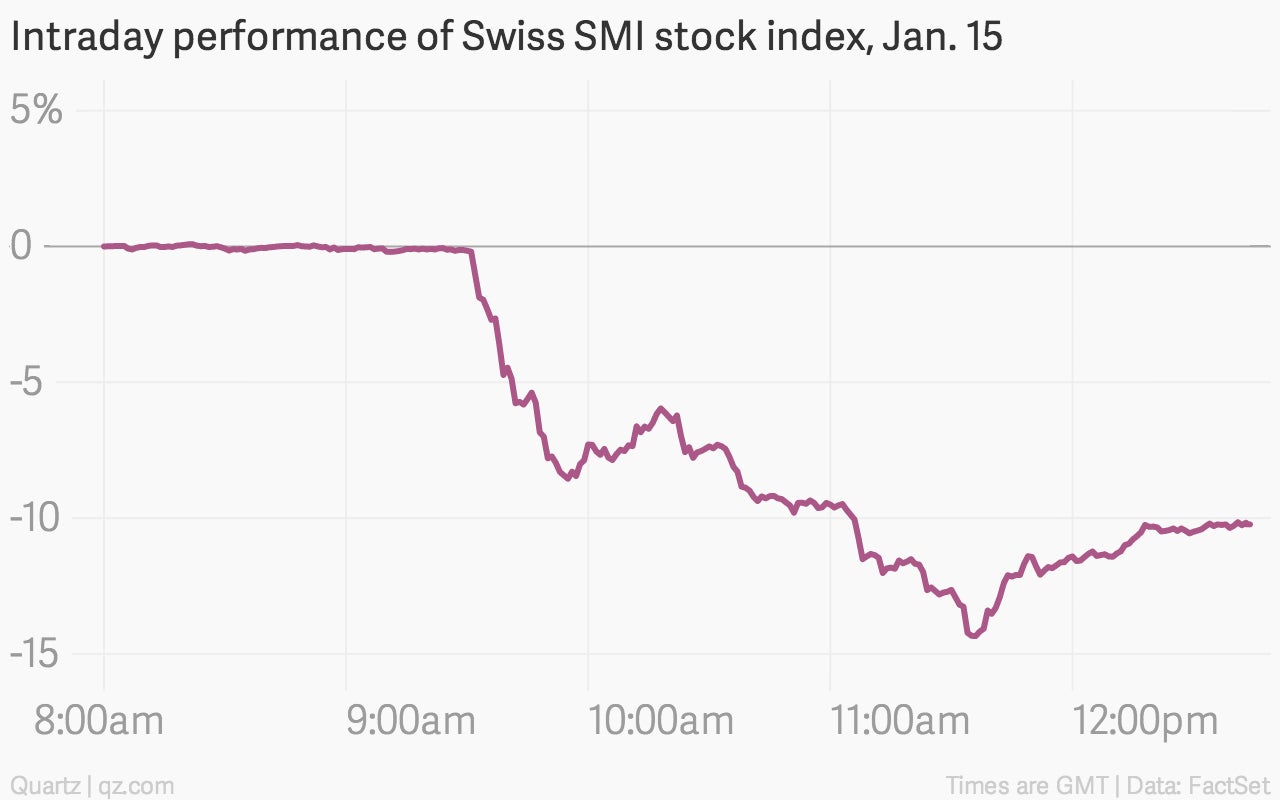

The Swiss franc is the sixth-most traded currency in the global foreign-exchange market, according to the Bank for International Settlements. As a result, trading is incredibly volatile across a wide range of markets today, with investors rethinking their assumptions for currency values, interest rates, and other fundamental market drivers. Swiss stocks in particular are getting battered, as the country’s export-oriented companies count the cost of a stronger franc:

The other people nervously watching the chart of a climbing franc are bankers and borrowers in Eastern Europe, where franc-denominated mortgages are popular. Broader European markets and US futures took a nosedive after the Swiss central bank announcement, but when traders got over their initial shock, markets rallied—perhaps on the hopes that the Swiss move is a strong signal that significant stimulus is coming from the European Central Bank.

And spare a thought for the executives and policymakers packing their bags for the World Economic Forum’s annual jamboree in the Swiss ski resort of Davos next week—the fondue and schnapps will be even more expensive than usual this year.