This week in central banking: Whatever

The European Court of Justice is about tell us what “whatever it takes” actually means. European Central Bank President Mario Draghi uttered the phrase in 2012 when markets feared the euro zone was on the brink of collapse, and it’s been the shorthand for the ECB’s monetary acrobatics ever since.

The European Court of Justice is about tell us what “whatever it takes” actually means. European Central Bank President Mario Draghi uttered the phrase in 2012 when markets feared the euro zone was on the brink of collapse, and it’s been the shorthand for the ECB’s monetary acrobatics ever since.

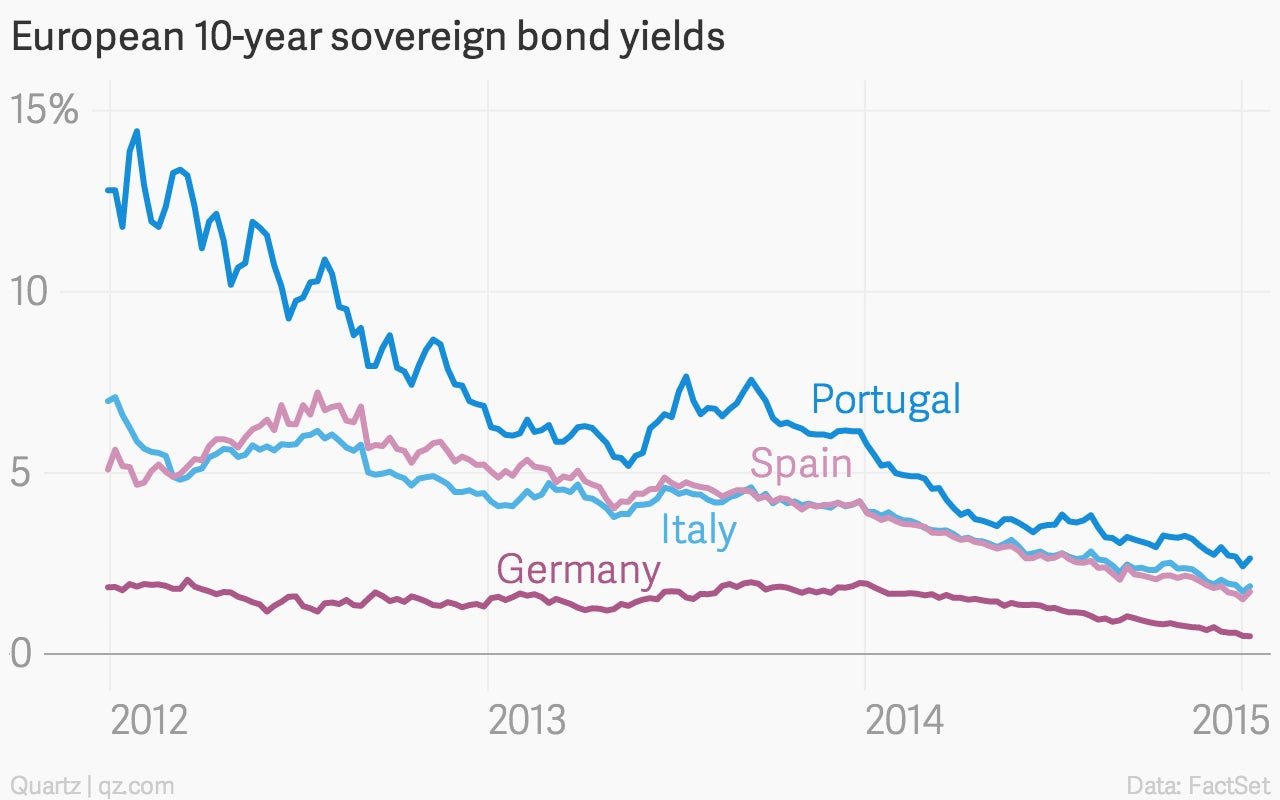

It originally meant buying enough European bonds to keep interest rates low and stoke the economy. But Germany, one of Europe’s largest and most powerful economies, hates inflation—which is what central bankers hope to see happen when they keep interest rates low. So Bundesbank president Jens Weidmann took the ECB to court in Germany, where a panel of the country’s top judges referred the case to the ECJ in Luxembourg.

The program the Bundesbank is targeting has not yet been used—and perhaps never will be. But everyone thought it was coming, and plenty of people still do, which is a big part of why so many euro zone bonds are yielding so little.

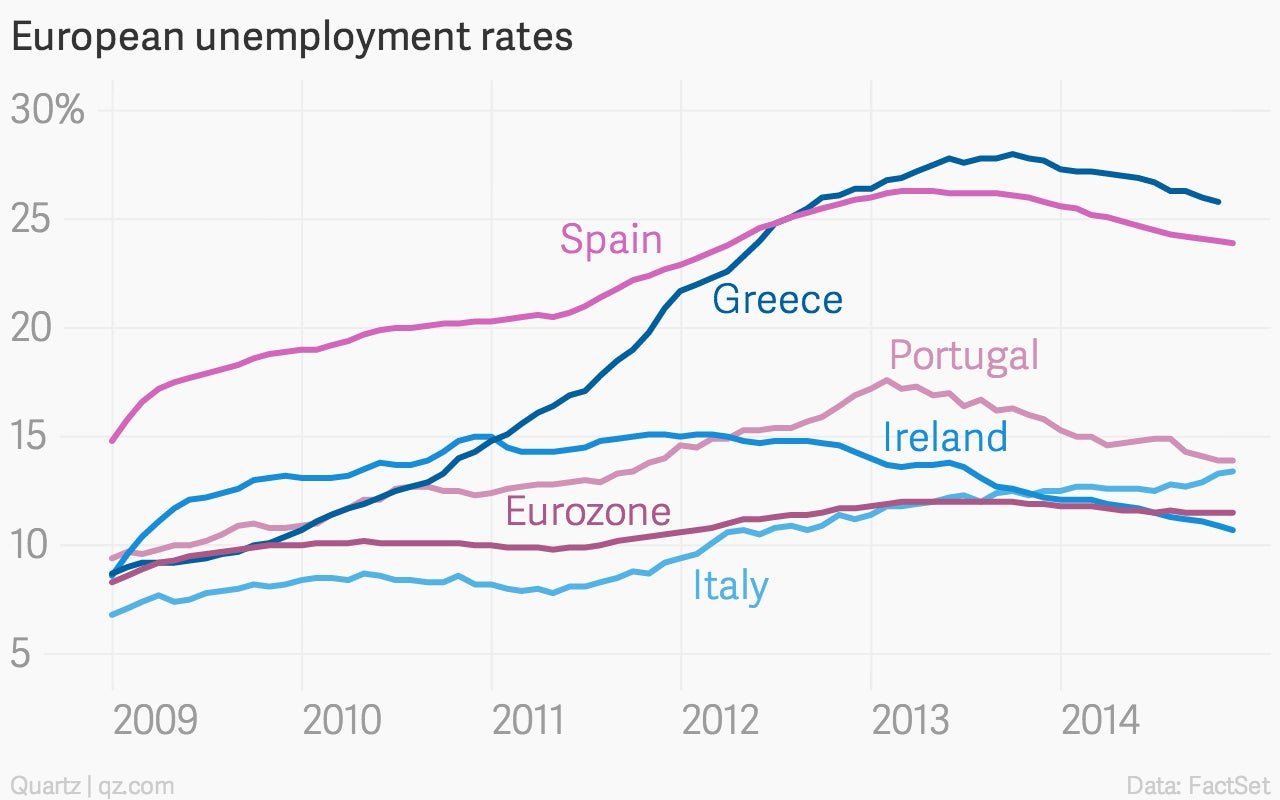

The Germans are opposed to seeing the ECB stick its neck out for the so-called “periphery” states, mostly in southern Europe, scared they won’t learn their lessons on debt.

Most of the periphery economies are seeing better unemployment rates since the peaks a couple years back, but the ”whatever it takes” pronouncement has done little to improve the unemployment picture for the euro zone overall.

The ECB has complained that eurozone governments aren’t doing their part to cure their ailing economies, and it wants to do what it can to help. It’s keeping a key interest rate negative, it’s trying really hard to prop up the market for loans, and it’s pushing cheap money on banks that don’t even seem to want it. Sovereign bond purchases are the last piece in a pretty disappointing puzzle on how to revive Europe’s sagging economic growth.

Nobody really expects the ECJ to side completely against the ECB. Not even the German court did that. But the opinion may influence Draghi’s latest gambit—a separate plan to increase the previously tightfisted (paywall) ECB’s balance sheet by €1 trillion through a different set of bond purchases. (Already it appears this new plan will be a few hundred billion euros smaller than that, and restricted to investment-grade bond purchases.)

Depending on what the ECJ has to say—an opinion is expected this week, with a final ruling to come in a few months—Draghi may have to give up on doing whatever it takes, and settle for doing whatever he can.