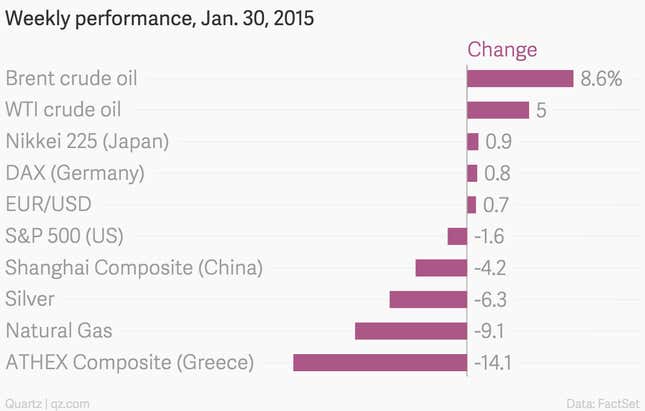

Tough talk between Greece’s new left-leaning leadership and Greece’s foreign creditors—the “troika” of the European Union, the International Monetary Fund, and the European Central Bank—made mincemeat of Greek markets this week. Both government bonds and stocks were hammered with the benchmark Athex Composite stock index down more than 14%. Yields on Greek government debt shot sharply higher as prices—which move in the opposite direction of yields—dropped as investors priced in an increased risk that Greece could default.

If this seems like an old story, it is. Doubts about the creditworthiness of Greece have periodically hammered markets since 2010. But given that Greece’s political leaders were just elected in large part because of their vows to resist austerity imposed by foreign creditors, the stage has been set for another round of wrangling that could conceivably result in Greece’s departure from the monetary bloc. Quartz’s Tim Fernholz laid out the stakes in a post earlier this week:

Greece doesn’t want to be cut loose from the euro zone, but Germany and the rest of the EU will find it hard to keep it in without offering politically unpopular debt relief. As Greece’s new finance minister, Yanis Varoufakis of the Syriza party, put it, “we must offer Mrs. Merkel a way of packaging the new deal that she can then sell to her parliamentarians.”

Of course there was more to the markets this week than Greece. We would be remiss not to note that oil prices, though still a long way down from where the were last summer, spiked on Friday. Reuters reported that the jump was linked to a sharp downturn in the number of US oil rigs, a sign supply might, at some point, come back into line with demand. The Nikkei rose, amid signs of solid job growth and a weaker yen. Chinese stocks fell as regulators sought to tamp down on margin trading. And US stocks slipped, amid slightly disappointed data on US GDP growth.