What if everything you thought you knew about the music business was completely wrong?

Put another way, what if the economic potential of music is being dramatically undervalued?

One company that thinks so is Kobalt Music, a London-based music publisher and platform provider that has today secured $60 million in fresh funding from investors including Google Ventures.

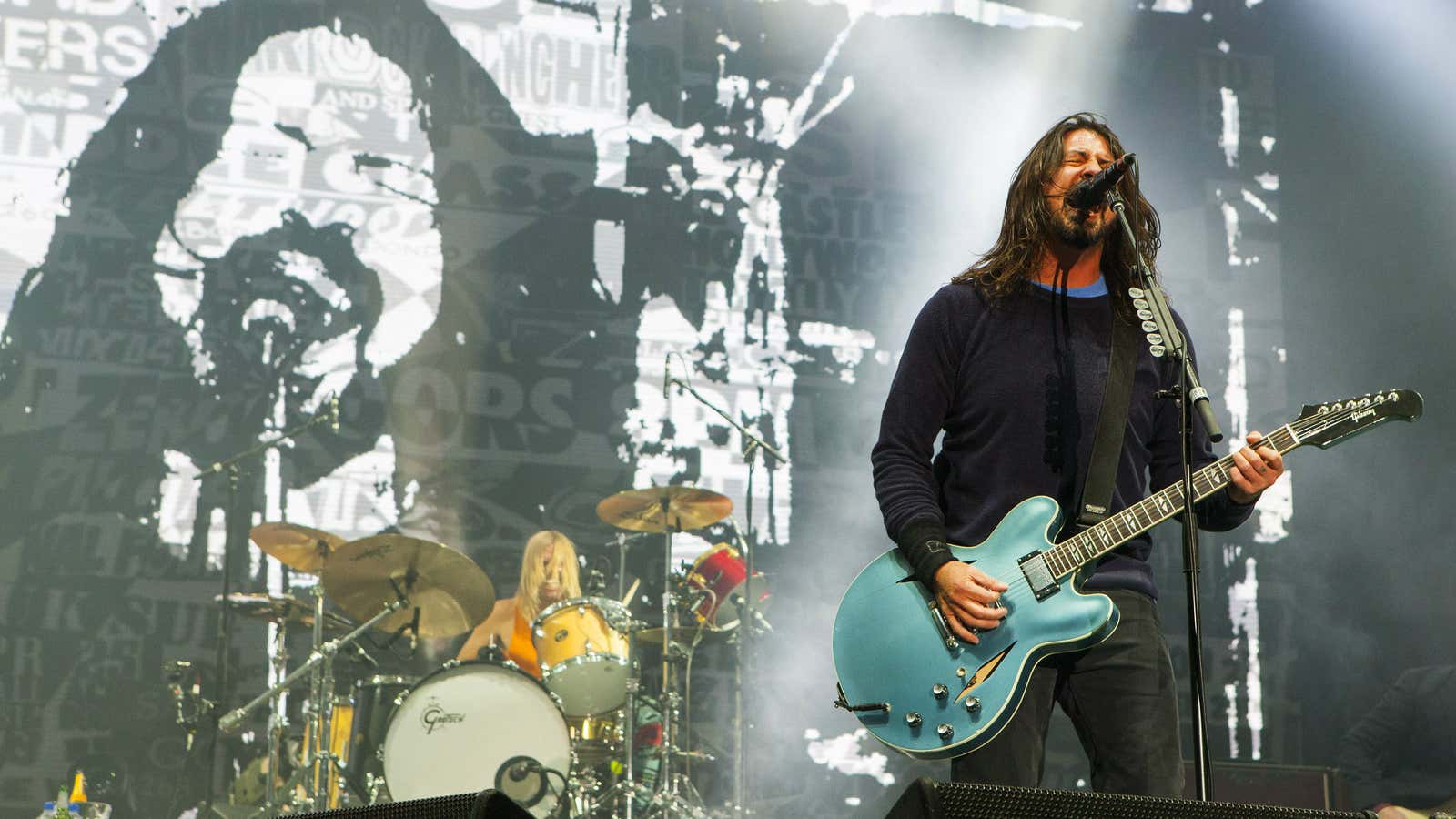

Venture capital funds, including Google’s, usually invest in early-stage, high-growth companies. But Kobalt has been around since 2000, and though it is a dominant player in its field (it claims to manage $3.5 billion in publishing assets and Paul McCartney, Beck, Dave Grohl, and Sam Smith are among the 8,000 songwriters on its books) it operates in a corner of the music business not normally considered to have much growth potential.

Music publishers sign up songwriters and then collect and distribute the royalties generated when songs by those writers are played on broadcast radio, television, or streaming services, or when they are featured in advertisements or movies. Publishers are distinct from record labels, which sign performers and then fund and promote their recordings, although some of the biggest music corporations, like Sony, have their feet in both camps.

Due to its stable cash flows, music publishing is a business that has appealed to pension funds and private equity over the years. It doesn’t have the kind of profile that venture investors, who usually are looking for gigantic returns to cover other risky bets, would be interested in.

Also, the prevailing narrative in the music industry at the moment is that the internet is destroying value. It busted the music industry’s product bundle, known as the album. It made what was once scarce ubiquitous, and thus less valuable and harder to charge for. Music publishers in particular have been engaged in some bitter struggles with internet companies (consider the fights Pandora has been engaged in).

Yet Kobalt embraces technology wholeheartedly. It argues that the audiences for creators of music are bigger now than ever before, and that there are more ways to reach them, thanks to the internet. ”The opportunities are enormous if people … are brave and connect and get away from [the practices] that the music industry has been operating on for years,” Kobalt founder and CEO Willard Ahdritz tells Quartz.

Kobalt’s annual revenue growth has averaged 40% over the past decade, and through its online portal, songwriters (and even other publishers) have the ability to monitor the millions or even billions of micro-transactions involving their music—when it is played on a streaming service like Spotify, or on YouTube, or when it is sold in either a physical or digital format. This helps the songwriters know when, and how much, they are going to get paid. It’s a nurturing, proactive approach—a refreshing change from the more antagonistic and defensive stance the traditional music business is renowned for.

Ahdritz thinks there is huge potential to unlock more value from music. There are 250 million consumers in markets like southeast Asia and South America that the music industry is yet to tap into, he says. He senses opportunity from emerging services like Snapchat (and whatever follows) as more people use the services to share and consume music.

If Ahdritz is to be believed, then we are on the brink of an explosion in music usage, akin to the way trade blossomed in 16th century Europe as trade barriers came down, or the way financial markets flourished in the 1980s as regulation lightened up, making way for innovation and expansion. “In this digital world, transparency drives liquidity, and liquidity drives volume,” Ahdritz says. If Kobalt makes it easier for businesses to license music, they’ll license it (and ultimately play it) more often, generating more royalties.

And that presumably appeals to investors like Google Ventures, which also has put money behind Uber, TuneIn Radio, and Nest, the thermostat maker.“The music industry is going through dynamic changes all around the world and Kobalt will be instrumental in shaping its future,” Google Ventures partner Bill Maris said in a press release.

Officially, Google’s venture arm is set up to generate financial returns on Google’s giant cash pile. But its investments have had strategic value at least once before—Google ended up buying Nest in its entirety. Whether Kobalt is similar remains to be seen. But music is an important weapon in the battle for the future of the internet. And that’s a battle Google would very much like to win.