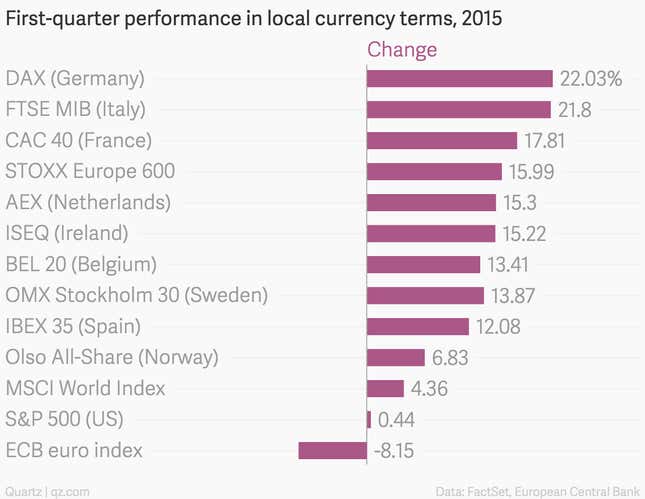

Euro-zone stocks have been a winning bet so far this year. Stocks in Germany and Italy both gained more than 20% in the first quarter.

Gobs of foreign cash are flowing into them, and for good reason: the European Central Bank has opened the floodgates, pumping money into the market with bond purchases that drive down interest rates and make it enticing to borrow and play the stock market.

The combination of bond buying and low interest rates also pushed the euro down by 8% in trade-weighted terms during the first quarter, a boon for exporters based in the euro zone—0f which there are many in Germany—and yet another reason for investors to load up on stocks from the continent.