A few of Yahoo CEO Marissa Mayer’s many acquisitions at the company have been aimed at adopting a smaller competitor’s product. For instance, Yahoo acquired Tumblr for its millions of younger users and video advertising firm BrightRoll for its programmatic ad network and technology. But many of its buyouts have taken a different tack: purchase the company to shut down the product and claim the talent instead.

In a Fast Company profile of Mayer published this week, Yahoo employees laid out their defense of the practice, known in Silicon Valley as ”acquihiring.” They say it was aimed at quickly building a team of mobile development experts (Yahoo only had 50 when Mayer arrived), which the firm, given its lowly reputation at the time, would have had trouble doing through recruiting alone.

Former mobile and now video chief Adam Cahan described the strategy to Fast Company as follows: “We would come in, quickly find those teams, inspire them about the work we were doing, and bring them on board.”

“When you have good people, it’s much easier to attract good people,” Yahoo engineering fellow Benoit Schillings told Fast Company. “It’s contagious.”

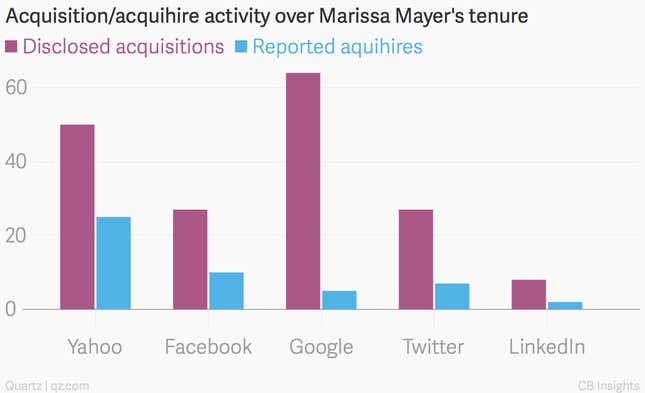

Acquihires have become a popular strategy among tech companies, but Yahoo has been particularly prolific with acuiqihiring relative to its competitors and peers, according to data collected by venture capital database CBInsights. Its acquihire data is compiled using media reports to assess whether the acquisition involved shutting down a product. Because companies do not always disclose the nature of the acquisition, the actual acquihire count may be even higher. Either way, based on this data, at least half of Yahoo’s 50 acquisitions since Mayer took the helm have been acquihires:

The jury is out on effectiveness of this approach. A former colleague of Mayer’s, Google HR chief Laszlo Bock, laid out a concise and cogent criticism of the practice in his new book:

It’s not clear yet whether acquihiring is a good way to build successful organizations. First, it’s fabulously expensive; Yahoo paid $30 million for Summly, shut it down, and fired all but three employees, retaining only Nick D’Aloisio and two others. That’s $10 million per person. And even when acquihires are “cheap,” they are still expensive: The thirty-one Xobni employees cost $1.3 million each. And after all that, they still need ongoing salaries, bonuses, and stock awards, just like other employees.

Acquihires also see their products killed. That’s a painful experience. While the money is supposed to make up for it, I’ve heard about many acquihired engineers across Silicon Valley who are just biding their time until they are fully vested and then plan to strike out on their own again. It’s also not clear that acquihire employees generate better outcomes than hired employees. Some do, but I haven’t seen evidence that it’s generally true.

He adds that two-thirds of mergers and acquisitions add no value or destroy value, even when the acquired product lives on.

Since Mayer has come on board, the company says it has gotten much better at hiring and retaining talent, which is at least partly backed up by data from recruiting platform Jobvite.

But in light of Bock’s analysis, boosting retention isn’t likely to recoup the cost of expensive acquihires, especially if employees are merely sticking around until their stock vests. Meanwhile, activist investors are already bristling at the idea of additional acquisitions, even after the multi-billion dollar windfall Yahoo enjoyed from its Alibaba acquisition.