Pity the poor—and increasingly poorer—gold bugs.

This bow-tie clad class of investors tends to see every economic data point as auguring a hyperinflation that never quite seems to materialize.

In fact, right now we have quite the opposite. Around the world, inflation is remarkably low, thanks largely to a sharp downturn in energy and commodity prices.

This phenomenon, known as lowflation, is an awful backdrop for investors hoping the price of gold will rise. After falling 28% in 2013, and 1.5% last year, gold prices are actually up ever so slightly so far this year. (A bit less than 1%, at last glance.)

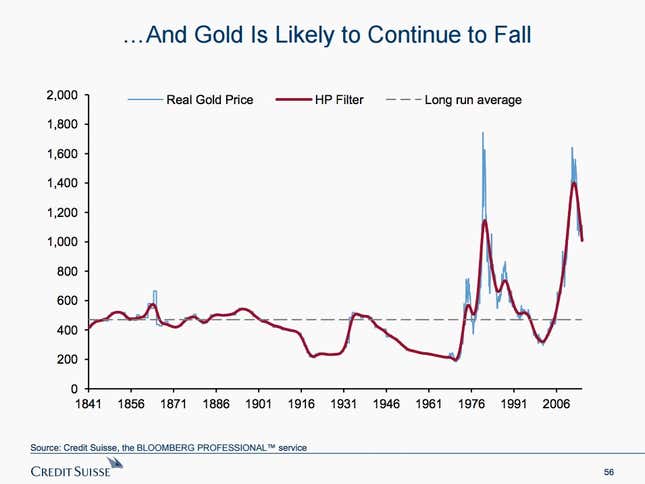

Of course, as with anything in the financial markets, you could have made a lot of money on the metal by buying at the right moment over the past decade. But in a recently published look at how they see asset classes performing over 2015, Credit Suisse analysts note that the long-term, inflation-adjusted average price for an ounce of gold is somewhere above $400. And that’s a very long way down from roughly $1,200 where gold is currently trading.