Despite all the hype about how online lending is going to topple traditional banking, many companies that lend money over the internet are still losing more money than they’re making.

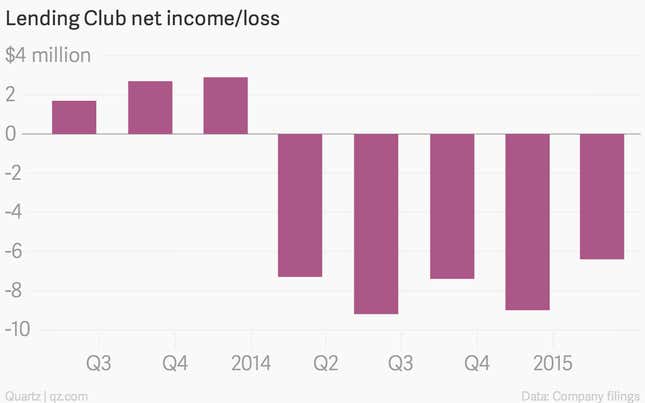

Lending Club, the world’s largest online marketplace lender, said Tuesday (May 5) that the company is still unprofitable even after more than doubling revenue and the number of loan originations.

That’s because Lending Club is spending more money on improving its technology, hiring engineers, and attracting new customers through sales and marketing, than it is making by originating loans. (A hefty sum is also going toward stock-based compensation for employees.)

Lending Club makes about 90% of its money by charging borrowers upfront fees each time they take out loans. Fees range from 1% to 5% per loan, depending on loan type, and increase for riskier borrowers.

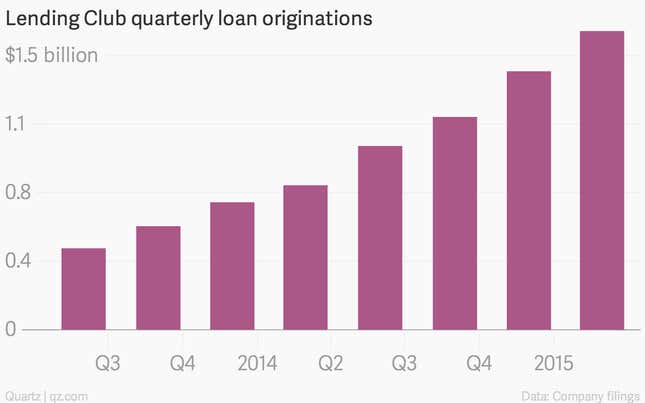

That means the company lives and dies on its ability to keep luring in more people to take out loans through its online platform. It also has an incentive to increase the size of each loan, granted it can determine the borrower can pay the money back.

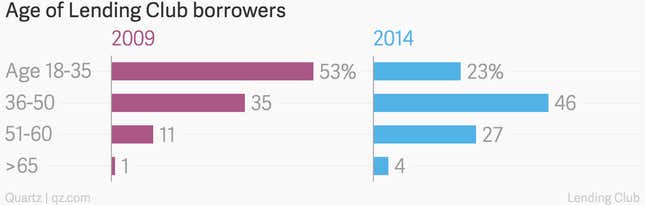

So far, it seems to be working as Lending Club moves from what it called younger, early adopters to a more mainstream customer base.

The online marketplace lender originated $1.6 billion in the first quarter of 2015, up from $791 million in the same period last year. But it booked a net loss of $6.4 million, slightly down from the $7.3 million loss during the same period last year.

While Silicon Valley investors might not bat an eye at the lack of profitability, the 5% drop in Lending Club’s shares Tuesday (May 5) shows that investors on Wall Street are not so forgiving. Its shares recovered in after-market trading, but it’s still down substantially since it went public last year and closed at around $23 a share.

For its part, Lending Club shrugs off the losses. It’s more focused on just getting more people to use its platform.

While Lending Club commands about three-quarters of US marketplace lending, the more than $4 billion in loans it originated last year pales in comparison to the $860 billion in loans on Wells Fargo’s balance sheet or the more than $3 trillion in US consumer debt outstanding.

“Our strategy is to grow very aggressively and that requires investment,” CEO Renaud Laplanche tells Quartz, explaining that the company will double the size of its engineering staff this year. “We are growing at triple digits, which is pretty unique for a public company.”

Laplanche says he stresses another financial metric—adjusted earnings before interest, taxes, depreciation, and amortization, or adjusted EBITDA—which doesn’t include stock-based compensation and acquisition expenses. By that measure, earnings rose to $10.6 million, from $1.9 million the year before.