Apple’s reign is over.

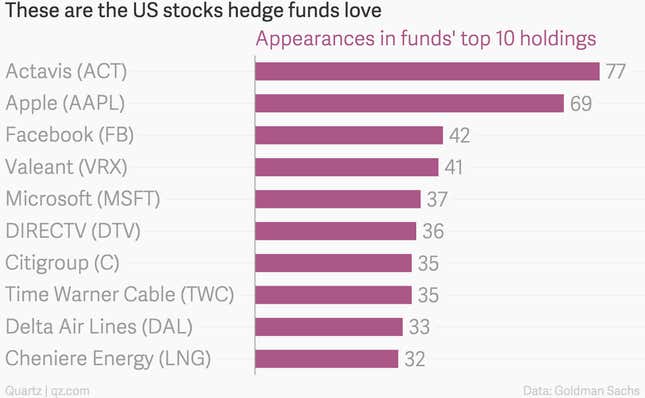

For a while, Apple reigned ”undisputed as the most popular hedge fund stock,” according to Goldman Sachs analysts.

But things have changed. The most recent iteration of Goldman Sachs’ quarterly update on holdings of hedge funds shows that the drug company Actavis has has taken over the top spot. Some 77 hedge funds reported having Actavis as one of their top 10 holdings.

For the record it’s Valeant, a Bill Ackman favorite, that has performed the best this year. It’s up more than 70%.

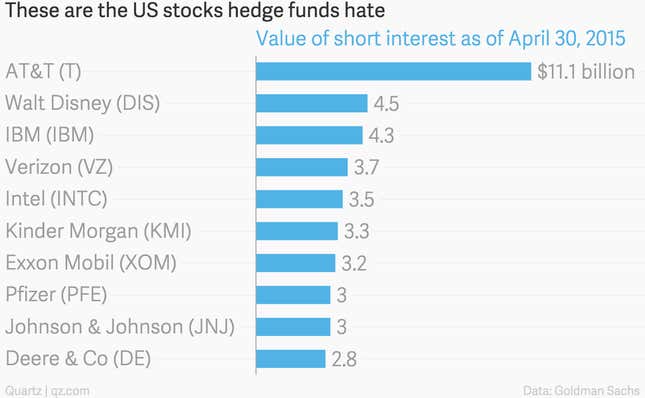

And here are few names that aren’t so favored, including the struggling Intel.

A few words of caution: We don’t know precisely when hedge funds bought or shorted these stocks. (Nor do we know if they have changed their positions since submitting their 13F filings at the SEC, which give you a quarterly peek at their investments.) Plus, it’s important to remember that, in the aggregate, hedge fund returns have been pretty mediocre lately. In fact, Disney, one of the hedgies’ most heavily shorted stocks, is up nearly 17% this year. Ouch.