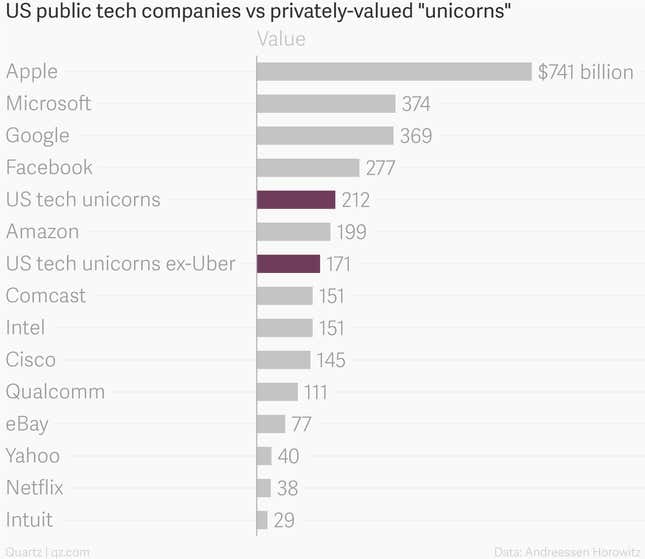

On June 15, Quartz reported that all of Europe’s tech companies privately valued at $1 billion or more, called “unicorns” by the tech-finance industry, were together worth less than half of Facebook. Lest anyone accuse us of anti-Europeanism, here is the corresponding chart for American tech firms:

These figures come from Andreessen Horowitz, a well-regarded Silicon Valley venture capital firm, with figures that were accurate at the time of collation on June 5. I haven’t updated the figures since it makes no material difference.

What is particularly striking is that a single start-up, Uber, is worth 18% of the $221-billion index of a hypothetical tech-unicorn index. Chuck in Airbnb, and the two together are make up more than quarter of the total value of America’s big tech companies.

The point isn’t that the companies are over-hyped (though it is useful to see the value of $1-billion firms put into some perspective).

Rather, it is the opposite—the venture firm’s researchers are instead making the (unsurprisingly self-serving) point that for investors, it makes more sense to invest in a basket of high-growth private firms than it does to put money behind a relatively mature public company already worth two-thirds of Microsoft.

The firm’s entire presentation, titled “US technology funding—what’s going on?” is available here. It is a revealing look inside the finance factories of Silicon Valley—and the thinking that goes with it.